Rendering credits: Vornado Realty Trust and Robert A.M. Stern Architects

Rendering credits: Vornado Realty Trust and Robert A.M. Stern Architects

UPDATE 11.6.2018 with unit table and recent photos:

220 Central Park South is poised to become the residential superstar of Manhattan real estate. Designed by one of the city’s most beloved architects, Robert A.M. Stern, this limestone-covered is set to become a worthy follow-up to Stern’s “limestone Jesus” at 15 Central Park West. Inspired by city’s most elite co-ops such as the San Remo, 993 Fifth Avenue and 740 Park, the building is encased in limestone and enormous windows present top-to-bottom views of Central Park.

After more than a decade in the works, details of the Steven Roth-conceived project have been kept to a minimum. Last month, the first two closings in the building were recorded. They are a pair of two-bedrooms on the 24th and 25th floor that closed for $14.632M and $13.186M accordingly. Last week, The Real Deal reported that the building is 83 percent sold with 98 of 118 units in contract. According to the Attorney's General office, Vornado is projecting a total sellout of $3,422,486,000 (up by $30 million since we first published this story in December 2017) and The Real Deal estimates the REIT will earn $1 billion in profits.

In the coming months, we'll also likely find out if the record-breaking $250 million penthouse and the rush of buyers clamoring for $50M+ apartments are indeed true. So to remind you of 220's extraordinary scope, we’ve cobbled together a list of bits released on the project over the years.

220 Central Park South is poised to become the residential superstar of Manhattan real estate. Designed by one of the city’s most beloved architects, Robert A.M. Stern, this limestone-covered is set to become a worthy follow-up to Stern’s “limestone Jesus” at 15 Central Park West. Inspired by city’s most elite co-ops such as the San Remo, 993 Fifth Avenue and 740 Park, the building is encased in limestone and enormous windows present top-to-bottom views of Central Park.

After more than a decade in the works, details of the Steven Roth-conceived project have been kept to a minimum. Last month, the first two closings in the building were recorded. They are a pair of two-bedrooms on the 24th and 25th floor that closed for $14.632M and $13.186M accordingly. Last week, The Real Deal reported that the building is 83 percent sold with 98 of 118 units in contract. According to the Attorney's General office, Vornado is projecting a total sellout of $3,422,486,000 (up by $30 million since we first published this story in December 2017) and The Real Deal estimates the REIT will earn $1 billion in profits.

In the coming months, we'll also likely find out if the record-breaking $250 million penthouse and the rush of buyers clamoring for $50M+ apartments are indeed true. So to remind you of 220's extraordinary scope, we’ve cobbled together a list of bits released on the project over the years.

In this article:

1954

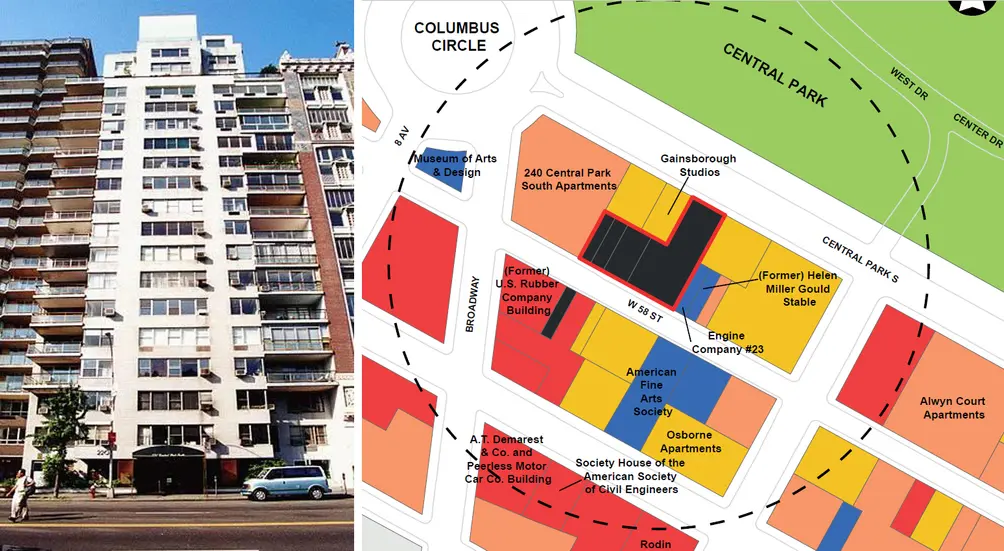

Pre-existing 220 Central Park South and map showing project location via VNO

Pre-existing 220 Central Park South and map showing project location via VNO

The year the now-demolished apartment building at 220 Central Park South was built. The 20-story, 124-unit rental building was designed by Mayer & Whittlesey and M. Milton Glass. The firm also designed the nearby 40 Central Park South and 240 Central Park South, which, like 220, are through-block buildings that extend to West 58th Street. The building replaced three nineteenth-century rowhouses and an apartment building, all built by the Appleby family.

In their "New York 1960 Architecture and Urbanism Between the Second World War and The Bicentennial," Robert A. M. Stern, Thomas Mellins and David Fishman provide the following commentary about the building: “The twenty-story building had coarsely detailed rows of double-hung aluminum windows set in white brick, corner balconies and a blocky elevator penthouse; a similarly dismal building faced Fifty-Eight Street and was separated from its companion by a garden. The setback base of the building on Central Park South compromised the street wall that was so critical to the framing of the park."

In their "New York 1960 Architecture and Urbanism Between the Second World War and The Bicentennial," Robert A. M. Stern, Thomas Mellins and David Fishman provide the following commentary about the building: “The twenty-story building had coarsely detailed rows of double-hung aluminum windows set in white brick, corner balconies and a blocky elevator penthouse; a similarly dismal building faced Fifty-Eight Street and was separated from its companion by a garden. The setback base of the building on Central Park South compromised the street wall that was so critical to the framing of the park."

$131.5 Million Property Sale

The price the now-defunct Clarett Group and the REIT Vornado Realty Trust paid the estate of Sara Korein for the 124-unit rental building at 220 Central Park South in 2005. The next year it was leaked that the developers were planning a ground-up residential building at the site with units expected to fetch more than $2,500 a square foot. The NY Times reported that the developers intended to replace the existing 20-story white brick building with a 41-story glass condominium tower designed by Pelli Clarke Pelli Architects.

Veronica W. Hackett, the managing partner of the Clarett Group, said the existing building was obsolete and had many maintenance problems. She said the new tower would be made to compete with some of the most expensive condominiums in Manhattan. It would rise twice the height and 25 percent larger than the existing structure and have two glass-walled apartments on most floors, almost all with park views. The first building permit was filed in September 2006 detailing a 507-foot-tall tower with 79 apartments spread across two wings.

Veronica W. Hackett, the managing partner of the Clarett Group, said the existing building was obsolete and had many maintenance problems. She said the new tower would be made to compete with some of the most expensive condominiums in Manhattan. It would rise twice the height and 25 percent larger than the existing structure and have two glass-walled apartments on most floors, almost all with park views. The first building permit was filed in September 2006 detailing a 507-foot-tall tower with 79 apartments spread across two wings.

80 Tenants Evicted

Nothing says Central Park South luxury more than dirty white brick (Google)

Nothing says Central Park South luxury more than dirty white brick (Google)

The number of tenants issued eviction notices in 2006 by Vornado/Clarett. Per the NY Times, “Under state law, developers can evict rent-stabilized tenants when their leases expire from buildings they plan to demolish if they demonstrate that they are acting in "good faith" to carry out their plans, typically by showing that they have approved building plans and financing in place.”

The developers were prepared to offer "six-figure" settlements to the 47 rent-stabilized tenants who occupy a total of 50 apartments. She said the remaining 34 or so market-rate tenants would be asked to leave when their leases expire or possibly to remain on month to month until the plan is completed. Tenant lawyer William Gibben tells the Times, "This is new territory. It's a scorched-earth policy. If this gets done, it is open season on every building in the city.”

Twenty-two rental tenants challenged the developers and prevailed in State Supreme Court, thus delaying the demolition of the building. In spring 2009, Justice Paul G. Feinman found that the state may have to conduct a formal environmental review, including a study of what effect the project, and its influx of wealthy buyers, “may have on population patterns or existing community character.”

The next year, the state’s Appellate Division unanimously reversed the lower court's ruling. The legal challenges with the tenants dragged on until December 2010 and ended when the development team paid a total of $40 million to buy out 26 holdout renters. Each tenant received between $1.3 million and $1.6 million apiece to vacate their rent-stabilized apartments.

The developers were prepared to offer "six-figure" settlements to the 47 rent-stabilized tenants who occupy a total of 50 apartments. She said the remaining 34 or so market-rate tenants would be asked to leave when their leases expire or possibly to remain on month to month until the plan is completed. Tenant lawyer William Gibben tells the Times, "This is new territory. It's a scorched-earth policy. If this gets done, it is open season on every building in the city.”

Twenty-two rental tenants challenged the developers and prevailed in State Supreme Court, thus delaying the demolition of the building. In spring 2009, Justice Paul G. Feinman found that the state may have to conduct a formal environmental review, including a study of what effect the project, and its influx of wealthy buyers, “may have on population patterns or existing community character.”

The next year, the state’s Appellate Division unanimously reversed the lower court's ruling. The legal challenges with the tenants dragged on until December 2010 and ended when the development team paid a total of $40 million to buy out 26 holdout renters. Each tenant received between $1.3 million and $1.6 million apiece to vacate their rent-stabilized apartments.

Gary Barnett: The One Last Holdout

(CityRealty)

(CityRealty)

While constructing One57, Extell Development’s Gary Barnett had been secretly assembling the site of Central Park Tower located directly south of Vornado’s 220. The savvy developer acquired the lease for the underground parking garage in 220 and rebuffed striking a deal with Vornado to relinquish the lease. Extell also purchased a parcel at 225 West 58th Street in 2006, in the middle of Vornado’s 220 assemblage. In 2009, Extell filed permits to build an 18-floor residential building at the site to be designed by CetraRuddy Architecture.

In an annual letter to shareholders, Vornado chairman Stephen Roth comments on Extell’s One57 saying, "We hear that the 1,000-foot-tall, direct park-view apartment tower under construction on 57th Street is pricing at $6,500 per square foot…. our 220 Central Park South site, just down the block, is better."

In summer 2012, scaffolding finally goes up on the tenacious white-brick rental, and demolition permits are filed for 229 and 231 West 58th Street, the two buildings west of Extell’s holdout lot. Despite Extell keeping the basement garage in operation, Vornado begins demolition on 220 and work is halted after debris falls from the job site. An angry Barnett tells WSJ, “It's outrageous that they're taking a risk with people's lives and properties when it doesn't do them any good." He goes on to say, "They're only tearing the building down to the third floor—so why are they going ahead and doing this demolition while the building is occupied? Let them wait."

In an annual letter to shareholders, Vornado chairman Stephen Roth comments on Extell’s One57 saying, "We hear that the 1,000-foot-tall, direct park-view apartment tower under construction on 57th Street is pricing at $6,500 per square foot…. our 220 Central Park South site, just down the block, is better."

In summer 2012, scaffolding finally goes up on the tenacious white-brick rental, and demolition permits are filed for 229 and 231 West 58th Street, the two buildings west of Extell’s holdout lot. Despite Extell keeping the basement garage in operation, Vornado begins demolition on 220 and work is halted after debris falls from the job site. An angry Barnett tells WSJ, “It's outrageous that they're taking a risk with people's lives and properties when it doesn't do them any good." He goes on to say, "They're only tearing the building down to the third floor—so why are they going ahead and doing this demolition while the building is occupied? Let them wait."

$194 Million Agreement

The rivaling developers officially settled in fall 2013 with Vornado paying Extell $194 million for land and air rights amounting to 137,000 zoning square feet. Included in the deal is the sale of Barnett’s intervening parcel at 225, and giving up their lease on the garage. Vornado also agrees to slightly reconfigure their project to allow Extell’s Central Park Tower to capture better views of Central Park

Vornado CEO Steven Roth says, “It took almost eight years to complete the assemblage, but it was certainly worth the time,” Soon after the deal was struck, Vornado officially announced their plans to build a 900+-foot-tall, 472,000-square-foot (zoning sf) condominium tower designed by Robert A.M. Stern. The site was cleared by the close of that year. The most recent figures for the project show it will have 118 apartments.

Vornado CEO Steven Roth says, “It took almost eight years to complete the assemblage, but it was certainly worth the time,” Soon after the deal was struck, Vornado officially announced their plans to build a 900+-foot-tall, 472,000-square-foot (zoning sf) condominium tower designed by Robert A.M. Stern. The site was cleared by the close of that year. The most recent figures for the project show it will have 118 apartments.

140 feet of Central Park-Facing Exposures

In 2013, Steven Roth proclaims 220 will have 140 feet of unobstructed Central Park views. The building will also be the tallest building within a block from Central Park. The final 27,608-square-foot through-block assemblage has 75 feet of direct frontage on Central Park South (West 59th Street) and 200 feet of frontage on West 58th Street.

The first renderings of the project are leaked in early 2014 showing a lanky limestone tower with broad north and south elevations. This initial design is glassier and more contemporary than what is now being built but shares a similar configuration of a 17-floor building (The Villas) facing Central Park South and the larger 70-floor tower facing West 58th Street. The sections will be connected through an arcaded passage and face onto a shared motor court.

The first renderings of the project are leaked in early 2014 showing a lanky limestone tower with broad north and south elevations. This initial design is glassier and more contemporary than what is now being built but shares a similar configuration of a 17-floor building (The Villas) facing Central Park South and the larger 70-floor tower facing West 58th Street. The sections will be connected through an arcaded passage and face onto a shared motor court.

Six More Robert A.M. Stern Gems to Come

Clockwise from upper-left corner: 520 Park Avenue, 70 Vestry Street, 30 Park Place, 14 Fifth Avneue, 20 East End Avenue and 250 West 81st Street (Robert A.M. Stern Architects)

Clockwise from upper-left corner: 520 Park Avenue, 70 Vestry Street, 30 Park Place, 14 Fifth Avneue, 20 East End Avenue and 250 West 81st Street (Robert A.M. Stern Architects)

News that Stern will be designing 220 surfaced in 2012. At the time Curbed said, "If Vornado is looking for a One57-killer, that's certainly one way to go about it.” Excluding 220, the number of New York condos Robert A.M Stern has designed since finishing his highly-regarded 15 Central Park West can be found above. The six other Stern condos are 30 Park Place, 520 Park Avenue, 20 East End Avenue, 14 Fifth Avenue, 70 Vestry Street and 250 West 81st Street. “Success breeds emulation,” said marketing doyen Nancy Packes.

Stern’s office is working alongside the executive architects of SLCE, the interior designer at the Office of Thierry W. Despont and the structural engineers of DeSimone Engineers. Heintges and Enclos are serving as the building envelope consultants.

Stern’s office is working alongside the executive architects of SLCE, the interior designer at the Office of Thierry W. Despont and the structural engineers of DeSimone Engineers. Heintges and Enclos are serving as the building envelope consultants.

360,000-SF of Alabama Limestone

220 is being wrapped in a creamy 2” thick Alabama silver shadow limestone facing. The material is warmer in hue than the nearby 15 Central Park West which uses Indiana Limestone. Per the curtain wall consultants, Heintges, “The material is ideal for the structure’s classical architectural profiles, such as the fluted vertical chevron units, curving corbels, and window banding.” The opulent albeit heavy limestone façade requires an intricate support system of stainless steel anchors attached to welded steel truss frames to adequately support the weight.

With no expense spared on the skin, limestone wraps all four sides of the building, even covering a concrete sheer wall along the tower’s south elevation. That side is also given false windows, making the solid wall indistinguishable from the other sides. According to Enclos, the windows are typically 10’ wide and range from 8’ 10” tall up to 22’ 6” depending on ceiling heights.

With no expense spared on the skin, limestone wraps all four sides of the building, even covering a concrete sheer wall along the tower’s south elevation. That side is also given false windows, making the solid wall indistinguishable from the other sides. According to Enclos, the windows are typically 10’ wide and range from 8’ 10” tall up to 22’ 6” depending on ceiling heights.

$3,422,486,000 Projected Sellout

The initial offering plan approved in early 2015 indicated a projected sellout of $2.4 billion. With the inclusion of additional units, the total sellout figure is now stands at $3,392,486,000 (August 2017). The offering is the second largest ever in the city, only behind Extell’s Central Park Tower across the street.

Per a 2015 version of the offering plan uncovered by The Real Deal, the building will have seven penthouses. Sources have said the most expensive penthouse will ask between $150 million and $175 million and would span nearly 20,000 square feet.

Per a 2015 version of the offering plan uncovered by The Real Deal, the building will have seven penthouses. Sources have said the most expensive penthouse will ask between $150 million and $175 million and would span nearly 20,000 square feet.

118 Opulent Condos

118 is the number of residential units according to the latest offering plan, of which more than 60 apartments are priced above $20 million. Per a 2015 article from The Real Deal, the average price per square foot of units in the buildings is an eye-watering $7,374. Condos in the tower portion of the building start at $11.95 million for a two-bedroom unit that measures just under 2,400 square feet. In the 17-story villa portion, which has 10 units, prices start at $32 million for a three-bedroom home measuring just under 4,000 square feet. Buyers will also be able to purchase 25 “suite units” that range from 388 square feet to 1,449 square feet.

Aside from the initial batch of renderings on Curbed, just a single image has been released showing 220's interiors. They show enormous floor-to-ceiling windows, coffered ceilings, ornate fireplaces, and herringbone floors. Some units will have wood or natural gas-burning fireplaces.

In a Q1 2015 earnings call, Roth says there are commitments for over $1.1 billion from buyers, representing over one-third of the building. Incredibly, the signings occurred in a six-week period without the launch of a full marketing center. “What has been accomplished in five or six weeks has never been done before,” says Roth. “Acceptance by brokers and buyers has been extraordinary and unprecedented.”

By November of 2015, Roth says that half the building’s units are in contract with 14 of the units selling north of $50 million, some with record-breaking price points. During an earnings call in fall 2015, Roth said 45 percent of buyers are New Yorkers purchasing a primary residence and 30 percent are Americans living in other cities.

Aside from the initial batch of renderings on Curbed, just a single image has been released showing 220's interiors. They show enormous floor-to-ceiling windows, coffered ceilings, ornate fireplaces, and herringbone floors. Some units will have wood or natural gas-burning fireplaces.

In a Q1 2015 earnings call, Roth says there are commitments for over $1.1 billion from buyers, representing over one-third of the building. Incredibly, the signings occurred in a six-week period without the launch of a full marketing center. “What has been accomplished in five or six weeks has never been done before,” says Roth. “Acceptance by brokers and buyers has been extraordinary and unprecedented.”

By November of 2015, Roth says that half the building’s units are in contract with 14 of the units selling north of $50 million, some with record-breaking price points. During an earnings call in fall 2015, Roth said 45 percent of buyers are New Yorkers purchasing a primary residence and 30 percent are Americans living in other cities.

$250 Million Penthouse

Photo courtesy of Enclos

Photo courtesy of Enclos

In the summer of 2015, sources told The Real Deal that a Qatari buyer is looking to combine multiple apartments into a single, $250 million penthouse in the sky. The price would shatter the New York record set by a penthouse at Extell’s One57, which sold for $100.5 million. The New York Post later reported that billionaire Chicago-based hedge fund founder Ken Griffin is the mysterious buyer of the $250 million quadruplex. Sting, who currently lives around the corner at 15 Central Park West, is also reportedly buying a triplex in 220.

$750,000 Parking Spots

Earlier this year, the developers approached the city’s planning department to increase the project’s parking capacity from the as-of-right 24 spaces to 64 spaces. Per The Real Deal, the offering plan submitted to the Attorney General’s office shows that parking spaces will cost $750,000 apiece. A gated motor court entered from West 58th Street will face onto both wings. Per the initial renderings the space will have a reflecting pool, central fountain, bronze lanterns, and a colonnaded entryway. A more recent rendering shows a more modest entrance with a glass canopy.

952 Feet Tall

Upon completion next year, 220 will be the 11th tallest building in NYC and third tallest residential building in the city behind 432 Park Avenue and One57. According to Crain’s New York, most of the condos will start on the 21st floor and are bolstered some 100 feet in the air by way of six mechanical floors whose ceiling heights range from 18 to 24 feet. The building topped out in summer 2017 and its uppermost floors are now being enclosed.

Five O’Clock Shadows

Illustraition from MAS' Accidental Skyline

Illustraition from MAS' Accidental Skyline

As 220 and others take to the sky, concerns grow over the shadows cast by the buildings and their possible adverse effects the city’s public spaces. 220 is one of the few towers that will grant nearly all its residents full-length views of Central Park. As a result, its broad stature will create long afternoon shadows across the park. In 2014, the Municipal Art Society released the report titled Accidental Skyline which details the recent proliferation of tall towers and some of their effects on public assets. The organization hopes the report will spark the need for new rules and regulations

1,000-Ton Dampening Pendulum

According to DeSimone, the project’s structural engineers, the 950-foot cast-in-place concrete tower will have a 1,000-ton dampening pendulum within its unoccupied top floors to compensate for high winds acting on the supertall. Company CEO, Stephen DeSimone says, “The multi-directional Tuned Mass Damper incorporated into the limited floor space at the top of the building functions to improve structural performance during extreme wind events.”

"People who buy $90 million penthouse apartments don't want to feel like they're in a boat," Mr. DeSimone tells Crain's. "Right now, engineers and builders are exploring the idea of advanced dampening systems that will anticipate the motion of a building and counteract it before it even sways. This is the last hurdle in building taller than we are already."

"People who buy $90 million penthouse apartments don't want to feel like they're in a boat," Mr. DeSimone tells Crain's. "Right now, engineers and builders are exploring the idea of advanced dampening systems that will anticipate the motion of a building and counteract it before it even sways. This is the last hurdle in building taller than we are already."

$5,000 a foot Buildable Cost

In late 2015, The Real Deal uncovered that Vornado is spending an incredible $5,000 per square foot to develop the $1.3 billion condo tower. That price tag includes $1,500 per foot for the land and $3,500 per foot in hard, soft and financial, according to Vornado CEO Steven Roth. “The building has the largest loss factor of any building of its type intentionally, so the amenity packages are extraordinary and are catering to this marketplace,” says Roth.

Amenities are to include multiple lobbies, a motor court, garage, a saltwater swimming pool, a bike room, a full-time doorman and concierge, a fitness center, juice bar, and spa; a swimming pool, a squash court, a basketball court, a golf simulator room, weight room, and a yoga/pilates room; a children’s amenity area, a library, lounge, meeting room, dining room, and a communal terrace.

Per the offering plan, Vornado is selling licenses for 67 storage units that are priced from $111,000 for a 44-square-foot space and go up to $211,000 for 84-square-foot-space. The building’s 44 wine cellars start at $133,000 for 38 square feet and go up to $287,000 for more expansive 82 square feet.

Amenities are to include multiple lobbies, a motor court, garage, a saltwater swimming pool, a bike room, a full-time doorman and concierge, a fitness center, juice bar, and spa; a swimming pool, a squash court, a basketball court, a golf simulator room, weight room, and a yoga/pilates room; a children’s amenity area, a library, lounge, meeting room, dining room, and a communal terrace.

Per the offering plan, Vornado is selling licenses for 67 storage units that are priced from $111,000 for a 44-square-foot space and go up to $211,000 for 84-square-foot-space. The building’s 44 wine cellars start at $133,000 for 38 square feet and go up to $287,000 for more expansive 82 square feet.

220 Central Park South as of the last week of October 2018 (CityRealty)

220 Central Park South as of the last week of October 2018 (CityRealty)

Would you like to tour any of these properties?

New Developments Editor

Ondel Hylton

Ondel is a lifelong New Yorker and comprehensive assessor of the city's dynamic urban landscape.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.