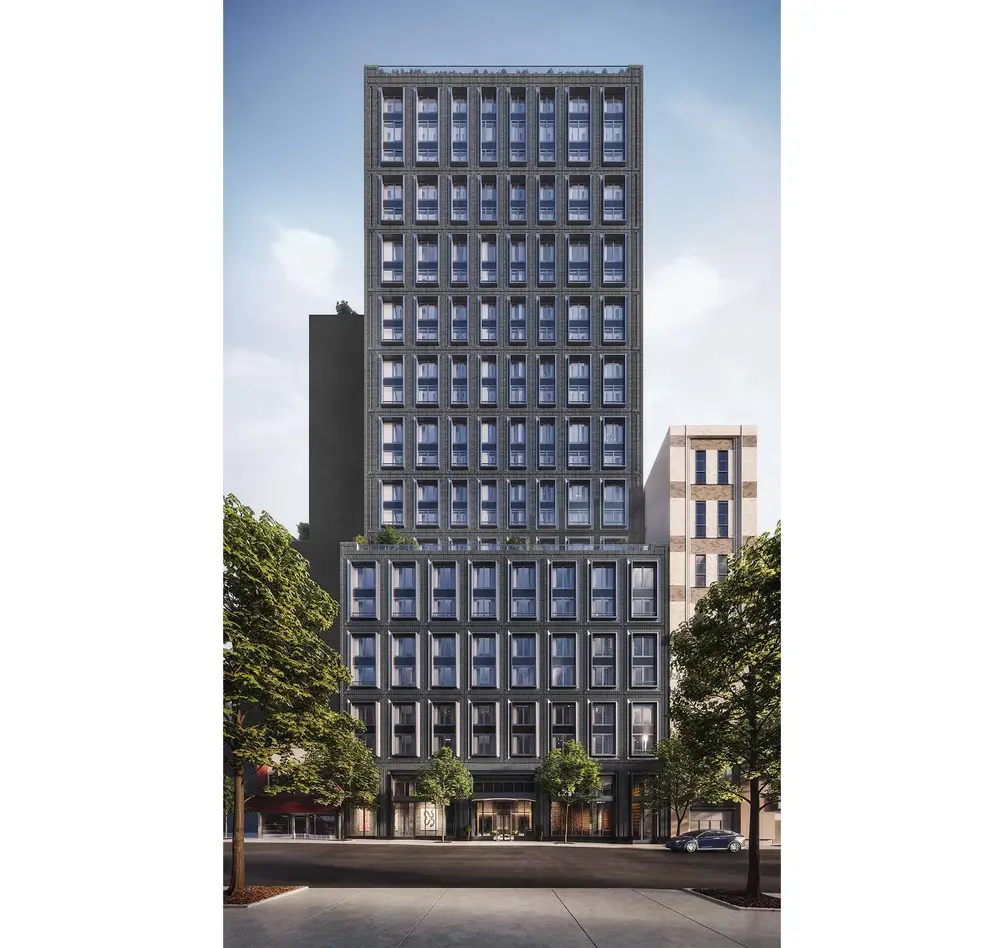

Exterior of the nearly sold out 108 Leonard (Elliman) and a high-floor availability at 130 William (Corcoran)

Exterior of the nearly sold out 108 Leonard (Elliman) and a high-floor availability at 130 William (Corcoran)

Finding the right New York real estate is never simple, but that is compounded with new construction condos, not only for the sheer volume of choice (nearly 3,000 new units expected to launch in Manhattan through 2025, and as many as 3,600 in Brooklyn and Queens) but for the extra considerations buyers are advised to take.

After finding an apartment, securing any required financing, and having an offer accepted, many think the next step is to move in and kick back. However, a few more steps are recommended, if not legally required, before one can take occupancy.

After finding an apartment, securing any required financing, and having an offer accepted, many think the next step is to move in and kick back. However, a few more steps are recommended, if not legally required, before one can take occupancy.

In this article:

Unit inspections vs. walkthroughs

Contrary to popular belief, new condos often have more problems than resale condos and coops because they haven’t yet been put to the stress test posed by daily living. As a result, buyers are advised to carry out a unit inspection (as advised in Part 2) and do a final walkthrough. It is also important to understand that inspections and walk-throughs are two very different types of inspections that happen at different moments. 111 West 57th Street, #QUADRUPLEX (Sotheby's International Realty)

111 West 57th Street, #QUADRUPLEX (Sotheby's International Realty)

Walk-through

In addition to a unit inspection before the contract signing, you’ll likely want to do a final walk-through before the move-in date. In most cases, the walk-through is carried out by the buyer and their real estate representative, but some buyers also bring other experts along. Among other things, be certain to check for the following when you do your walkthrough:Repairs

- Ensure that repairs or installations that were promised to be completed prior to your move-in date have taken place

Appliances

- Ensure that all appliances have been installed - e.g., if your contract includes a washer and dryer, ensure that it has been delivered and is operational

- Ensure that the stove is working by turning all burners on and off. If you have a gas appliance, check to see if the gas is working; if it isn't, find out why (n.b., if a gas stove is not turning on, it may point to a larger underlying problem in the building)

- Check the temperature of the interior of the refrigerator and freezer

Fixtures

- Ensure that light and dimmer switches are all working

- Ensure that all light fixtures are working

- Ensure that bathroom fixtures and faucets are all working

Water and plumbing

- Flush the toilet to ensure that it is working

- Turn on the shower to ensure that there is adequate water pressure and that the temperature controls are properly set

- Run all the taps to check the drainage

Finishes

- Ensure that the floors, countertops, and other finishes match the quality of those promised in the offer

- Check to see if there are any scratches or scuff marks on the walls, floor, and ceiling (note that these may occur during appliance installation)

- Ensure that all doors and door handles, including closet and exterior doors, are properly installed

- If windows are promised to open, ensure that they do

Electrical and HVAC systems

- Test all electrical outlets to ensure that they are working

- Ensure that all heat and air conditioning units are functioning

Electronics

- Test the intercom, door buzzer, and smart lock system (if applicable) to ensure that they are functional

- If smart home features have been incorporated into your apartment, test to be sure that they are accessible and working

Safety and security

- Check to see if your gas and fire alarms have been installed and are working

- If there is a home security system or video surveillance system, ensure it is installed and working

- Ensure that there is a peephole in your front door, as is required by the Housing Maintenance Code

- Ensure that the floors, countertops, and other finishes match the quality of those promised in the offer

- Check to see if there are any scratches or scuff marks on the walls, floor, and ceiling (note that these may occur during appliance installation)

- Ensure that all doors and door handles, including closet and exterior doors, are properly installed

- If windows are promised to open, ensure that they do

Electrical and HVAC systems

- Test all electrical outlets to ensure that they are working

- Ensure that all heat and air conditioning units are functioning

Electronics

- Test the intercom, door buzzer, and smart lock system (if applicable) to ensure that they are functional

- If smart home features have been incorporated into your apartment, test to be sure that they are accessible and working

Safety and security

- Check to see if your gas and fire alarms have been installed and are working

- If there is a home security system or video surveillance system, ensure it is installed and working

- Ensure that there is a peephole in your front door, as is required by the Housing Maintenance Code

Common red flags

A few common red flags to be on the lookout for include:- Reversed hot and cold water pipes and reversed water faucets

- Faulty ductwork

- Warped and scratched flooring

- Slow drainage in the bathroom or kitchen

- Incomplete work

- Unauthorized replacements of fixtures and appliances

Who and what to bring to a walk-through

- Your phone, to record damages and problems

- Your phone charger, to test electrical outlets

- An expert – if you and your agent are not up to the task, bring a professional inspector or trusted contractor or handyperson along to help identify potential problems

- A note-taking device – your phone or a pen and piece of paper are essential since you’ll also want to create a “punch list” of everything that needs to be completed or fixed before you move in

Next steps

If your walkthrough revealed any lingering problems (e.g., improperly installed appliances, scratched or damaged floors and walls, slow drains, or low water pressure) or missing features (e.g., installation of an unauthorized appliance), at this point, the repairs and replacements are still the responsibility of the sponsor. If you don’t want to wait for the unit’s sponsor to address the problems, estimate the cost of addressing the repairs and replacements yourself and ask that the amount be deducted from your closing costs. Image by Gerd Altmann from Pixabay

Image by Gerd Altmann from Pixabay

Closing, Moving In, and Establishing an Outside Date

Closing

In most cases, sponsors expect potential buyers to close within 30 days of written delivery of the closing. This is known as the “30-Day Alert.” If a buyer fails to do so, sponsors will typically impose a penalty (in some cases, up to $1,000 a day). Since 30 days is a short time to close, many real estate attorneys insist on including a contingency clause that provides a 10 to 15-day grace period.Certificate of Occupancy

While closes often take longer than expected due to a delay on the buyer’s side (e.g., the financing approval is delayed), in many cases, the delay in new construction condos is the developer’s fault. This is usually due to the fact that the developer hasn’t yet been able to obtain a Certificate of Occupancy (CO) or Temporary Certificate of Occupancy (TCO). In most new construction condos, the close happens after a TCO is issued. A TCO is issued when the Department of Buildings has determined that a building is safe to occupy but still has one or more outstanding issues that need to be resolved before a final CO can be issued. Notably, you can’t close with a CO or TCO.The importance of establishing an outside date

From supply chain delays that slow construction and installations to Department of Building delays that prevent the timely issuance of the paperwork needed to declare a building inhabitable, it often takes longer than expected for a building to receive its TCO. For buyers, this can cause a range of problems, including with lenders. As a result, it is important for buyers to establish an outside date—an agreed-upon date by which the construction must be completed. In most cases, if the construction isn’t completed by these dates, the potential buyer is free to walk away without penalty or with only a partial penalty.Closing costs and fees

Closing costs are higher when purchasing a condo than a coop. In most cases, closing costs on New York City condos are at least 3% and may run as high as 5% of the unit’s value. Most of your closing costs will come in the form of transfer taxes, which is 2.625% on all units worth more than $500,000. If your unit costs more than $1 million, you’ll also be on the hook for an additional mansion tax. Other potential costs include a mortgage recording tax, though it is only applicable if your unit is financed.In addition to applicable taxes, there are several costs related to the move-in. For example, most condos will ask for a move-in fee to ensure they can cover the cost of any move-in-related damages (e.g., scratches and dents to floors, walls, and elevators). Depending on the building, the move-in fee will be anywhere from $500 to $1,000, though some buildings also ask for a larger damage deposit.

How and when to take possession of a new construction condo

Once you officially close, you will get the keys to your unit, but you may or may not move in immediately. In some new construction condos, your unit may be complete, but the unit may have a TCO due to ongoing construction in common areas (e.g., the units may be complete while the lobby or gym remains under construction). As a result, you may or may not want to delay your move-in. You may also want to hire an interior designer and your own contractors (e.g., painters) to do additional work on the unit prior to your move-in date. For all these reasons, how and when you take possession of your new construction condo and actually move in are usually different dates. Image by Muhammad Abubakar from Pixabay

Image by Muhammad Abubakar from Pixabay

After move-in

Common charges

After you move into a condo, in addition to covering your mortgage, you’ll have monthly fees. Common charges in a condo can vary widely, depending on the type of building and amenities. More information on the structure of fees may be found here.Warranties

When you buy a new construction condo, the appliances are new, which means most will be under warranty, at least for the first one to three years. After that, there are no guarantees, which is why buyers sometimes purchase a home warranty. In fact, home warranties not only cover major appliance repairs but also home-systems repairs for an extended period. If you don’t like surprises, investing in a home warranty may be a great idea.Assessments

While an assessment is unlikely during the first decade of your building’s life, if a major repair is needed, it is possible that the condo board will decide to implement an assessment to cover the costs. In most cases, there is little one can do when hit with a high assessment. Fortunately, in most cases, assessments are added as a monthly charge on top of one’s fees and spread out over several years.Unit appreciation and resale potential

While there are exceptions (e.g., small boutique condos in Manhattan have held steady over the past decade), condos tend to be an exceptional investment in New York City. Since 2010, many condo buyers, especially in Brooklyn and Queens, have seen their values double in just a decade. Location is often a key factor, but the resale value of condos is also determined by other factors, including how many units are owner-occupied. Unless the condo has failed to attract buyers or is failing to age well (e.g., is plagued by structural issues), it will likely yield an enviable return over its first five to ten years.Rules against flipping your unit

Some, but not all, condos and coops have a flip tax. While flip taxes on HDFC coops can be as high as 30% to discourage buyers from frequently flipping their units, condos that have flip taxes generally only charge between 1% and 3%. Also, in many condos, flip taxes only apply to buyers who flip within a certain timeframe (e.g., the first two to five years). But potential flip taxes aren’t the only reason selling after just a few years is not advantageous. Unless you’ve owned and lived in your unit for at least two years, you’ll also have to pay capital gain taxes on the sale of your unit.Renting your unit

While coops often have strict rules against subletting, especially in the first two to three years following the purchase, condos tend to be far more flexible. In fact, many condos are purchased as investment properties and rented out from day one. But that doesn’t mean that there are no restrictions. Depending on the condo’s by-laws, you may have to pay a monthly fee to rent your unit. In addition, most condo boards will want to screen your tenants (e.g., they may ask for credit and housing court checks). The condo board may also reserve the right of first refusal on the lease.While much of the information presented in this article can be applied to condos that are still under construction, the following listings in new developments are open for immediate occupancy. However, they may not be available for much longer: Market data shows that the buildings are over 75% sold.

New development condos approaching sellout

Upper West Side

88% sold

Vandewater

Vandewater

12 one- to four-beds from $1.31M

Morningside Heights

32 stories | 178 units

Delivery Q1 2021

Vandewater

Vandewater

Vandewater, #10H (Brown Harris Stevens Development Marketing LLC)

79% sold

The Westly

The Westly

6 two- to five-beds from $2.95M

Upper West Side

20 stories | 51 units

Delivery Q2 2022

The Westly (Reuveni LLC)

The Westly (Reuveni LLC)

The Westly, #16C

$6,375,000

Riverside Dr./West End Ave. | Condominium | 3 Bedrooms, 3.5 Baths | 2,467 ft2

The Westly, #16C (Reuveni LLC)

96% sold

200 Amsterdam

200 Amsterdam

7 two- to four-beds from $3.95M

Lincoln Center

52 stories | 112 units

Delivery Q2 2021

200 Amsterdam (Serhant)

200 Amsterdam (Serhant)

200 Amsterdam, #PH2 (Serhant)

Upper East Side

78% sold

1289 Lexington Avenue

1289 Lexington Avenue

6 three- to five-beds from $3.95M

Carnegie Hill

18 stories | 61 units

Delivery Q2 2019

1289 Lexington Avenue (CityRealty)

1289 Lexington Avenue (CityRealty)

1289 Lexington Avenue, #18C

$5,100,000

Carnegie Hill | Condominium | 3 Bedrooms, 3.5 Baths | 2,792 ft2

1289 Lexington Avenue, #18C (Brown Harris Stevens Residential Sales LLC)

81% sold

200 East 75th Street

200 East 75th Street

6 three- to five-beds from $5.15M

Lenox Hill

18 stories | 36 units

Delivery Q3 2025 (anticipated)

200 East 75th Street (Compass)

200 East 75th Street (Compass)

200 East 75th Street, #11B (Compass)

82% sold

The Treadwell

The Treadwell

6 two- to four-beds from $2.48M

Lenox Hill

28 stories | 66 units

Delivery Q1 2024

The Treadwell (Brown Harris Stevens)

The Treadwell (Brown Harris Stevens)

The Treadwell, #23A (Brown Harris Stevens Development Marketing LLC)

Midtown

82% sold

111 West 57th Street

111 West 57th Street

7 three- to five-beds from $13.8M

Billionaires' Row/Midtown West

84 stories | 60 units

Delivery Q2 2020

111 West 57th Street (Sotheby's International Realty)

111 West 57th Street (Sotheby's International Realty)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

111 West 57th Street, #QUADPLEX80

$110,000,000

Midtown West | Condominium | 5 Bedrooms, 6+ Baths | 11,480 ft2

111 West 57th Street, #QUADPLEX80 (Sothebys International Realty)

76% sold

611 West 56th Street

611 West 56th Street

10 one- to four-beds from $888K

Hell's Kitchen/Midtown West

37 stories | 77 units

Delivery Q4 2021

611 West 56th Street (Douglas Elliman)

611 West 56th Street (Douglas Elliman)

611 West 56th Street, #12 (Douglas Elliman Real Estate)

98% sold

505 W 43

505 W 43

7 studio to three-beds from $805K

Hell's Kitchen/Midtown West

16 stories | 123 units

Delivery Q3 2019

505 W 43

505 W 43

505 W 43, #12H (Corcoran Sunshine Marketing Group)

Over 90% sold

520 Fifth Avenue

520 Fifth Avenue

3 three-beds from $5.95M

Midtown West

55 stories | 129 units

Delivery Q4 2025 (anticipated)

520 Fifth Avenue (Corcoran Group)

520 Fifth Avenue (Corcoran Group)

520 Fifth Avenue, #PH79 (Corcoran Sunshine Marketing Group)

83% sold

35 Hudson Yards

35 Hudson Yards

8 two- to four-beds from $4.75M

Midtown West

71 stories | 143 units

Delivery Q3 2019

35 Hudson Yards (CityRealty)

35 Hudson Yards (CityRealty)

35 Hudson Yards, #7403 (Corcoran Sunshine Marketing Group)

Downtown

Over 95% sold

277 Fifth Avenue

277 Fifth Avenue

6 two- to four-beds from $3.65M

NoMad/Flatiron District

55 stories | 129 units

Delivery Q4 2018

277 Fifth Avenue (Corcoran Group)

277 Fifth Avenue (Corcoran Group)

277 Fifth Avenue, #49B

$4,990,000 (-.1%)

Flatiron/Union Square | Condominium | 2 Bedrooms, 2 Baths | 1,557 ft2

277 Fifth Avenue, #49B (Douglas Elliman Real Estate)

83% sold

Maverick

Maverick

7 two- to four-beds from $2.35M

Chelsea

21 stories | 87 units

Delivery Q2 2022

Maverick (CityRealty)

Maverick (CityRealty)

Maverick, #16C (Douglas Elliman Real Estate)

86% sold

The Cortland

The Cortland

10 one- to four-beds from $2.5M

West Chelsea

26 stories | 144 units

Delivery Q2 2022

The Cortland (CityRealty)

The Cortland (CityRealty)

The Cortland, #12BE (CORE Group Marketing LLC)

98% sold

Greenwich West

Greenwich West

8 studio to three-beds from $1.36M

Hudson Square/Soho

27 stories | 170 units

Delivery Q3 2020

Greenwich West (CityRealty)

Greenwich West (CityRealty)

Greenwich West, #PH29C (ALIGNMENT RE LLC)

92% sold

108 Leonard Street

108 Leonard Street

7 one- to five-beds from $2.3M

Tribeca

13 stories | 166 units

Delivery Q3 2019

108 Leonard Street (Douglas Elliman)

108 Leonard Street (Douglas Elliman)

108 Leonard, #8B (Douglas Elliman Real Estate)

96% sold

130 William

130 William

12 one- to four-beds from $1.5M

Financial District

61 stories | 242 units

Delivery Q4 2020

130 William (right)

130 William (right)

130 William, #64B (Corcoran Sunshine Marketing Group)

Brooklyn

Over 90% sold

Quay Tower

Quay Tower

9 two- to six-beds from $2.09M

Brooklyn Heights

30 stories | 121 units

Delivery Q1 2020

Quay Tower (CityRealty)

Quay Tower (CityRealty)

Quay Tower, #24A (Serhant)

Over 95% sold

The Brooklyn Grove

The Brooklyn Grove

15 studio to three-beds from $675K

Downtown Brooklyn

27 stories | 184 units

Delivery Q2 2019

The Brooklyn Grove (Nest Seekers LLC)

The Brooklyn Grove (Nest Seekers LLC)

The Brooklyn Grove, #25A

$1,575,000

Downtown Brooklyn | Condominium | 2 Bedrooms, 2 Baths | 1,161 ft2

The Brooklyn Grove, #25A (Nest Seekers LLC)

Final sponsor listings in new development buildings

The Diana, #304S (Compass)

166 Washington Avenue, #4A (Corcoran Group)

265 20th Street, #PHL

$1,825,000

South Slope - Greenwood Heights | Condominium | 3 Bedrooms, 2 Baths | 1,283 ft2

265 20th Street, #PHL (Compass)

168 Plymouth, #THB (Douglas Elliman Real Estate)

The Lexi, #PHA (Nest Seekers LLC)

Gracie Green, #PENTHOUSE9 (Douglas Elliman Real Estate)

Park House Chelsea, #8W (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.