Various images from new development condos currently selling in NYC

Various images from new development condos currently selling in NYC

From pristine interiors and state-of-the-art appliances to eco-friendly environments and top-level services, there are many reasons to purchase in a newly constructed building. By and large, newly constructed buildings are cleaner, greener, and more convenient as they have been built to serve the needs of contemporary New Yorkers. Still, buying in a newly constructed building can present unexpected challenges. This article examines six potential risks and challenges associated with buying in a newly constructed building.

In this article:

Financing

While one might assume that lenders would prefer newly constructed buildings to aging buildings, it is usually more difficult to secure financing for a purchase in a new building, and the reason may come as a surprise. Lenders typically only agree to lend to buyers after a certain percentage of a building's units have already gone into contract. Depending on the building, the percentage will differ but is usually between 15 to 50 percent. Fortunately, in most developments, “preferred lenders” are brought on board to bridge the gap, but this also isn’t ideal. It ultimately means that buyers have fewer choices when shopping for a mortgage and, as a result, may end up with a much higher mortgage rate than they would if they could freely shop for financing.Another common catch-22 when attempting to finance a unit in a newly constructed building is that most lenders will only issue a mortgage after the building has obtained a Certificate of Occupancy or Temporary Certificate of Occupancy. In order to obtain even a Temporary Certificate of Occupancy, however, the building must be close to completion.

Closing costs

Closing costs on condos are nearly always much higher than closing costs on coops because coop buyers don’t pay a mortgage recording tax. However, closing costs on newly constructed condos are also higher than closing costs on resale condos. In most cases, this is due to an expectation that the buyer rather than the seller (in this case, the developer or sponsor) is expected to cover all or most of the closing costs. Notably, closing costs include attorney fees, and for a variety of reasons, attorney fees are also nearly always higher when closing on a new condo versus a resale coop or condo.Move-in dates

As many New Yorkers discovered during the pandemic, anticipated move-in dates on newly constructed buildings can be postponed for months and, in extreme cases, much longer. From permits and inspections to labor shortages and supply-chain troubles, a lot of things can delay the completion of a residential building project. For buyers, these delays not only add to the anxiety of moving but can prove costly. If, for example, a buyer has purchased a new condo and is selling an existing unit to finance the purchase, a long delay may result in both deals falling through. More often than not, however, move-in delays result in buyers being forced to rent while they wait for their newly constructed condo to be completed. Given the cost of moving, storage, and renting in New York City, move-in delays can add tens of thousands of dollars to one’s closing.Construction errors

Even in luxury developments, a lot of things can go wrong during the construction process, and some problems won’t become visible until after the building has become occupied. These problems include drainage and plumbing problems, faulty electrical work, foundation cracks, HVAC system problems, and aesthetic defects (e.g., peeling paint and floors that can’t hold up to the wear-and-tear experienced in large residential buildings). In extreme cases, construction errors can result in certain parts of newly constructed buildings being rendered unusable. In most cases, construction errors are minor and simply result in new residents being forced to live around the buzz of ongoing maintenance work for longer than expected.Community and culture

Many New York City buildings have a unique community or culture that has developed over many decades of habitation. It can be difficult to move into a building with an established community or culture, but when it comes to New York City housing, the timeless adage “better the devil you know than the devil you don’t” also seems to hold true. When you move into an existing building, it is usually possible to gain at least some sense of what to expect once you arrive. For example, if you’re looking for a child-friendly building or a building that welcomes musicians who practice at home, you’ll likely be able to assess the tolerance for crying children or trombone playing prior to moving in. In newly constructed buildings, it is virtually impossible to anticipate whether the community and culture of the building will ultimately be a good fit for you and your family over time.Long-term return on investment

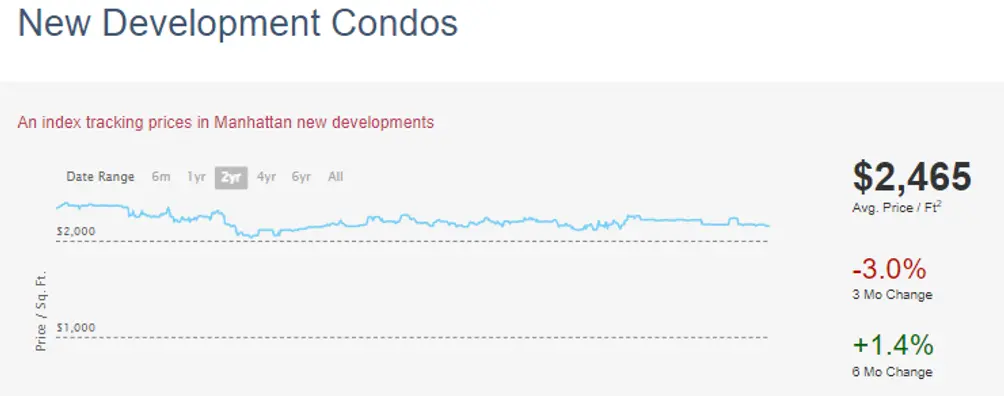

Buying in New York City is nearly always a strategic long-term investment. Still, buying in a newly constructed building does pose a slightly higher risk. In addition to the possibility that the newly constructed building may suffer from chronic problems (e.g., ongoing leaks), there is also a risk that the building may end up being largely unoccupied or end up being home to more renters than owner-occupants. While unoccupied units and units inhabited by renters don’t necessarily impact the value of one’s property, when the situation is extreme (i.e., the building is mostly unoccupied or home to a third or more renters), the value of one’s property may be negatively impacted. Here, it is also important to bear in mind that the Federal Housing Authority (FHA) even restricts mortgages on condo communities that aren’t at least 35 percent owner-occupied (until 2019, the FHA required at least 50 percent of units to be occupied by owners). CityRealty index tracking the average PPSF of select new development condos in Manhattan (https://www.cityrealty.com/nyc/building-indices/new-development-condos/building-gallery/114)

CityRealty index tracking the average PPSF of select new development condos in Manhattan (https://www.cityrealty.com/nyc/building-indices/new-development-condos/building-gallery/114)

The bottom line is that buying a newly constructed unit has many advantages, but it also tends to come with increased uncertainty and higher closing costs. If you know and accept the risks and higher price tag, however, it is nearly always a great investment.

Deeply Discounted Listings in New Development Buildings

Financial District - Battery Park City - Downtown

Tribeca Green, #8F (Corcoran Sunshine Marketing Group)

77 Greenwich Street, #26B

$1,550,000 (-11.4%)

Financial District | Condominium | 1 Bedroom, 1.5 Baths | 842 ft2

77 Greenwich Street, #26B (Christies International Real Estate Group LLC)

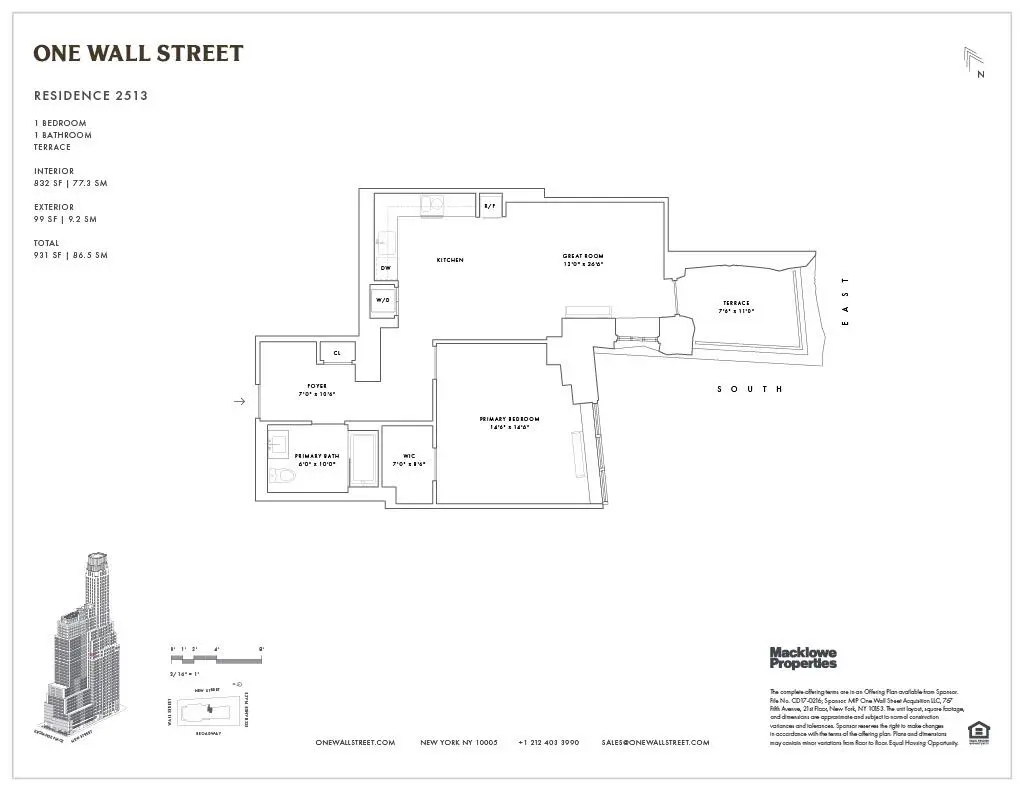

One Wall Street, #2513

$1,795,000 (-12.7%)

Financial District | Condominium | 1 Bedroom, 1 Bath | 832 ft2

One Wall Street, #2513 (One Wall Street Sales LLC)

100 Franklin Street, #PHSOUTH

$4,995,000 (-16.7%)

Tribeca | Condominium | 3 Bedrooms, 3.5 Baths | 2,854 ft2

100 Franklin Street, #PHSOUTH (Douglas Elliman Real Estate)

The Lofts at 62 Wooster, #5

$14,995,000 (-14.3%)

SoHo | Condominium | 4 Bedrooms, 4.5 Baths | 5,874 ft2

The Lofts at 62 Wooster, #5 (Compass)

One Essex Crossing, #PHC

$2,015,000 (-19.2%)

Lower East Side | Condominium | 1 Bedroom, 1.5 Baths | 1,171 ft2

One Essex Crossing, #PHC (Corcoran Sunshine Marketing Group)

Lantern House, #PH1015 (Corcoran Sunshine Marketing Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

One High Line, #WEST14C

$9,300,000 (-16.0%)

Chelsea | Condominium | 4 Bedrooms, 4.5 Baths | 2,867 ft2

One High Line, #WEST14C (Corcoran Sunshine Marketing Group)

Midtown

35 Hudson Yards, #7303

$8,900,000 (-10%)

Midtown West | Condominium | 4 Bedrooms, 4.5 Baths | 3,436 ft2

35 Hudson Yards, #7303 (Corcoran Sunshine Marketing Group)

505 W 43, #11G (Douglas Elliman Real Estate)

547 West 47th Street, #321

$1,855,000 (-12.1%)

Midtown West | Condominium | 2 Bedrooms, 2 Baths | 1,022 ft2

547 West 47th Street, #321 (Corcoran Sunshine Marketing Group)

611 West 56th Street, #10

$4,350,000 (-22.3%)

Midtown West | Condominium | 4 Bedrooms, 4.5 Baths | 3,289 ft2

611 West 56th Street, #10 (Corcoran Sunshine Marketing Group)

50 United Nations Plaza, #27A

$4,575,000 (-12.6%)

Turtle Bay/United Nations | Condominium | 3 Bedrooms, 3 Baths | 2,609 ft2

50 United Nations Plaza, #27A (Douglas Elliman Real Estate)

Sutton Tower, #PH47

$15,500,000 (-19.5%)

Beekman/Sutton Place | Condominium | 4 Bedrooms, 3.5 Baths | 4,765 ft2

Sutton Tower, #PH47 (Corcoran Sunshine Marketing Group)

Upper East Side

Archive Lofts, #601 (Corcoran Sunshine Marketing Group)

323 E 79th Street, #4

$2,490,000 (-12.3%)

Yorkville | Condominium | 3 Bedrooms, 2.5 Baths | 1,856 ft2

323 E 79th Street, #4 (Corcoran Group)

The Park Mansion, #PENTHOUSE

$4,600,000 (-13.2%)

Yorkville | Condominium | 3 Bedrooms, 3.5 Baths | 2,308 ft2

The Park Mansion, #PENTHOUSE (Douglas Elliman Real Estate)

1289 Lexington Avenue, #18A

$8,800,000 (-10%)

Carnegie Hill | Condominium | 5 Bedrooms, 5.5 Baths | 3,609 ft2

1289 Lexington Avenue, #18A (Brown Harris Stevens Residential Sales LLC)

The Wales, #4C (Corcoran Sunshine Marketing Group)

Upper West Side

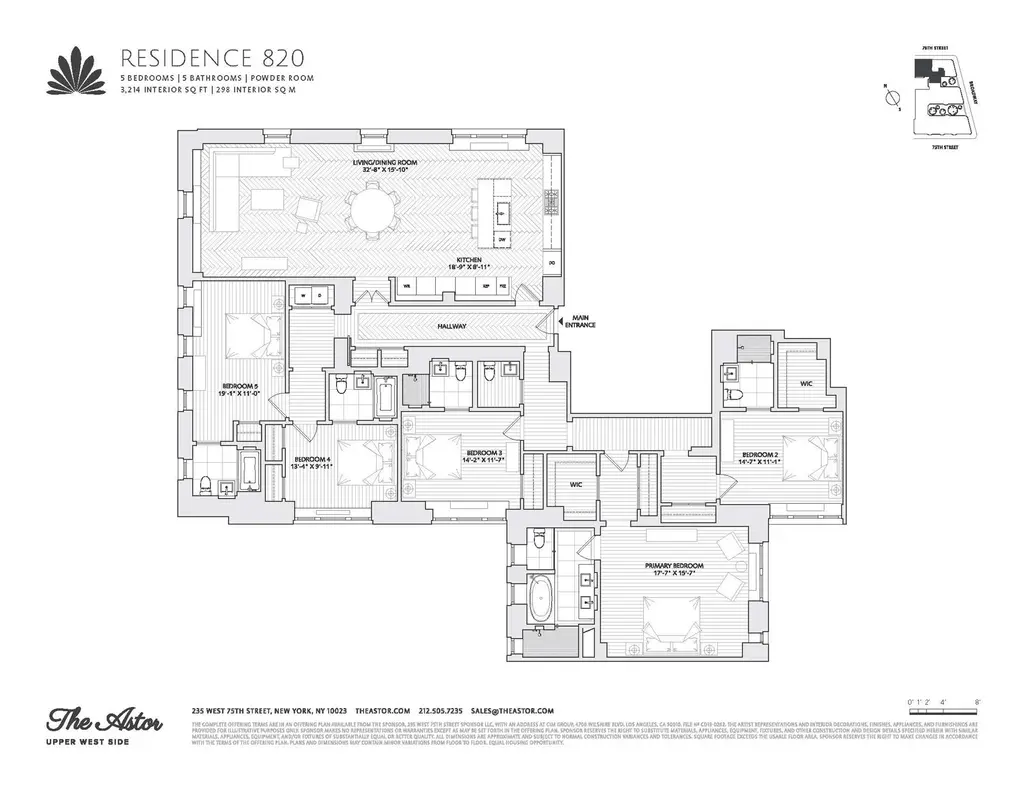

The Astor, #820

$6,750,000 (-14%)

Broadway Corridor | Condominium | 5 Bedrooms, 5.5 Baths | 3,214 ft2

The Astor, #820 (Douglas Elliman Real Estate)

393 West End Avenue, #14C

$5,995,000 (-14.5%)

Riverside Dr./West End Ave. | Condominium | 4 Bedrooms, 3.5 Baths | 2,713 ft2

393 West End Avenue, #14C (Brown Harris Stevens Residential Sales LLC)

The Westly, #11A

$4,995,000 (-15.3%)

Riverside Dr./West End Ave. | Condominium | 4 Bedrooms, 3.5 Baths | 2,292 ft2

The Westly, #11A (Reuveni LLC)

Upper Manhattan

Circa Central Park, #8B (Reuveni LLC)

Smithsonian Place, #202 (Douglas Elliman Real Estate)

Brooklyn

Umbrella Factory, #1E (MNS)

Oosten, #PH5 (Compass)

The Acacia, #unit1 (PEI ZHI)

122 Palmetto Street, #4R (Douglas Elliman Real Estate)

The Diana, #202 (Compass)

The Benny, #1D

$698,000 (-12.8%)

Prospect Lefferts Gardens | Condominium | 1 Bedroom, 1 Bath | 670 ft2

The Benny, #1D (Real New York)

2654 East 18th Street, #2D (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.