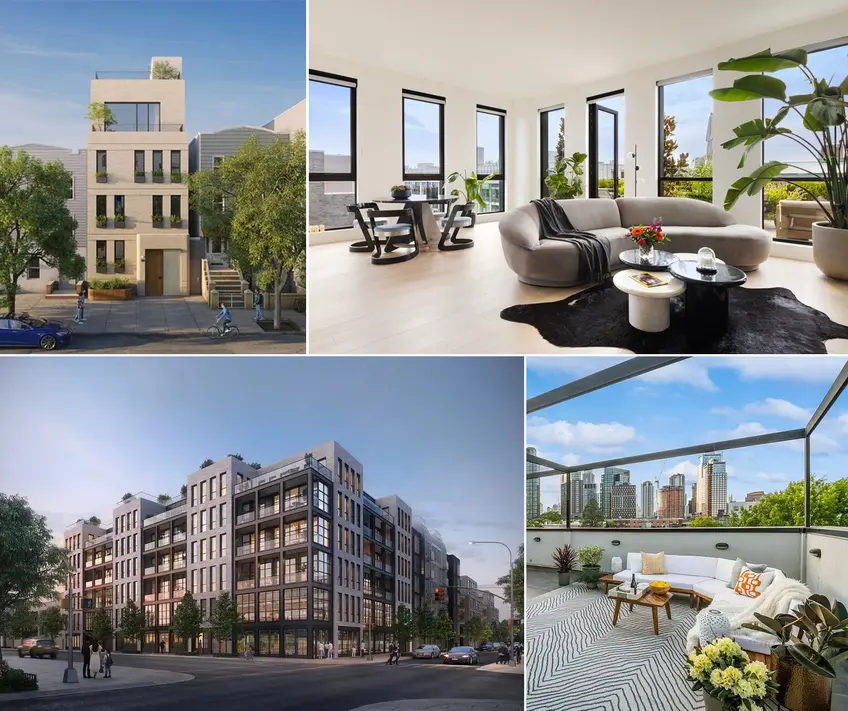

Various new development condos now selling in New York City

Various new development condos now selling in New York City

In many other U.S cities and internationally, deposit structures on pre-construction properties and properties currently under development are different than they are on resale properties. Acknowledging that the property may not be complete for over a year, buyers are often permitted to pay their down payment off gradually (e.g., to make an initial 5 percent deposit and pay the remaining amount off between the time of the first deposit and the close).

In New York City, this relatively common deposit structure for new construction properties, including pre-construction condos and condos under development, is extremely rare. In most cases, even if the condo won’t be complete for several years, buyers are expected to come in with at least 20 percent or more down.

In New York City, this relatively common deposit structure for new construction properties, including pre-construction condos and condos under development, is extremely rare. In most cases, even if the condo won’t be complete for several years, buyers are expected to come in with at least 20 percent or more down.

In this article:

Minimum deposits on new condos

Like any other purchase in New York City, buyers looking for properties in the new construction condo market should expect to bring at least 20 percent to any deal. Foreign buyers are often expected to bring more to deals—on average, between 35 and 50 percent. The higher threshold for foreign buyers reflects lending rules and is by no means a reflection of developers’ interest in selling to foreign buyers. Indeed, in New York City, the new construction condo market is generally a welcoming place for foreign buyers who tend to experience far fewer barriers to entry than they do when attempting to buy in coops or even established condos.

Preparing to transfer a deposit

Once the deposit amount is determined, it will need to be transferred to the developer’s attorney’s escrow account. At 20 percent or more of the purchase price, in most cases, the developer’s attorney will request a wire transfer. Typically, the buyer’s real estate attorney will provide the buyer with all the information needed to complete the wire transfer at their bank. The information required to complete a deposit transfer includes:- The name associated with the escrow account

- The address associated with the escrow account

- Their bank account number or IBAN

- Their bank’s full name and address

- Their bank’s SWIFT/BIC number

The advantage of holding deposits in escrow

Once a buyer has paid their deposit, it will be held in the developer’s attorney’s escrow account, which ensures the developer won’t be able to access the deposit until after closing. Restricting the developer’s access to deposit funds until after closing is advantageous to buyers in two key ways. First, by restricting the developer’s access to the escrow funds until after closing, buyers can rest assured that if the development isn’t completed on time or isn’t completed as promised, the developer will be able to return their deposit since the funds will still be available. Second, this practice also serves as a means to motivate developers to complete projects on time or at least close to the original deadline.Conditions for returning deposits

In most cases, once a buyer has put down a deposit, the deposit is only returned in rare cases. For example, in the case of a resale condo or coop, a deposit may be returned if, upon inspection, the property is found to have a significant structural flaw. In some instances, before the final closing, previously undisclosed information about the financial status of the condo or coop may also come to the surface, prompting the buyer to back out of the deal. However, in the case of new construction condos, deposit returns are far more common.When one buys a pre-construction condo or even a condo under development but not yet finished, the likelihood of the deal not coming to a final close is much higher for two key reasons. First, there is the common problem of delayed closings, though it is important to bear in mind that many condo projects are delayed. For this reason, deposits are typically only returned when the delay has reached a point when it is considered unreasonable. Since developers must inform buyers about projected delays, a developer’s failure to do so may also give a buyer grounds to opt out and demand their deposit back. Second, condo projects that are completed but are either plagued by construction errors or fail to deliver promised features, including premium finishes, can also represent grounds for a buyer to opt out of the deal and trigger a deposit return.

Conclusion

In summary, in New York City, deposit structures on new construction condos are nearly identical to other deposit structures. Unlike resale properties, however, buying a new construction condo presents more unknowns, which is why it is essential to ensure the contract includes contingencies that will protect one’s deposit if the project doesn’t finish in a reasonable timeframe or feature the amenities or finishes initially promised.Manhattan Boutique Buildings

458 West 20th Street, #4D (Coldwell Banker Warburg)

Park House Chelsea, #PHA (Compass)

Iron Lofts, #3 (Compass)

The Wren, #5 (OFFICIAL)

Nearly Sold Out Brooklyn Condo Buildings

The North, #PH1 (MNS)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

661 Driggs Avenue, #PHA (Corcoran Group)

30 Skillman Avenue, #GARDEN

$2,095,000

Williamsburg | Condominium | 2 Bedrooms, 2.5 Baths | 1,800 ft2

30 Skillman Avenue, #GARDEN (REAVIS PARTNERS LLC)

78 Meserole Avenue, #1 (Compass)

144 Freeman Street, #3A (Corcoran Group)

109 Troutman Street, #3B (Corcoran Group)

218 Classon Avenue, #PH

$1,395,000

Bedford-Stuyvesant | Condominium | 2 Bedrooms, 2 Baths | 1,003 ft2

218 Classon Avenue, #PH (Corcoran Group)

531 Classon Avenue, #3B (Corcoran Group)

501 Myrtle Avenue, #5A (Serhant LLC)

984 Bergen Street, #RESIDENCE1

$1,700,000

Crown Heights | Condominium | 2 Bedrooms, 2 Baths | 1,580 ft2

984 Bergen Street, #RESIDENCE1 (Corcoran Group)

Winthrop Gardens, #1A (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.