Following escalating prices during the first half of the decade, Manhattan residential real estate remained flat in 2019, with condos showing slight gains in average pricing and a modest decline in sales volume. Find the full CityRealty 2019 Manhattan Year-End Report here

and a few highlights below.

In this article:

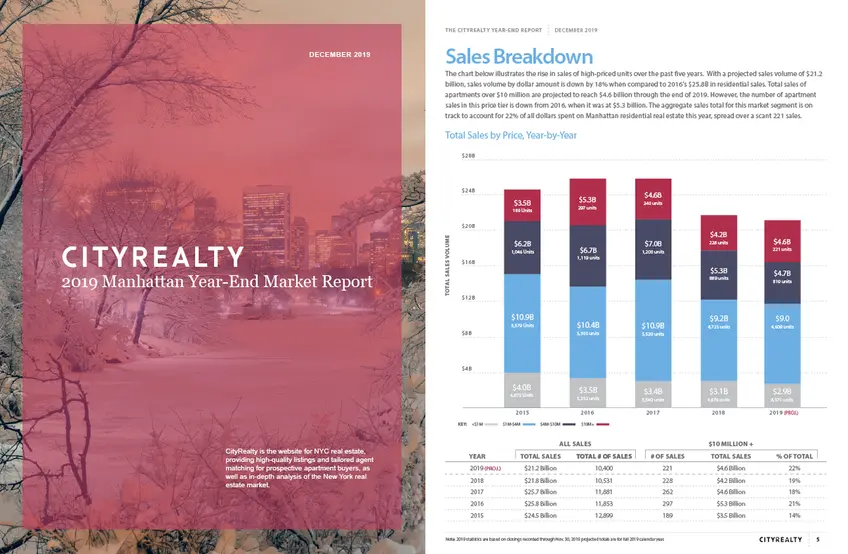

• The Manhattan residential market analyzed by CityRealty consists of condos, co-ops, and condops south of 96th Street on the East Side and south of 110th Street on the West Side. Approximately 10,400 residential units are expected to close in 2019, down from 10,531 in 2018.

• There was a small increase in the average price paid for an apartment in 2019, rising from $2.07 million to $2.12 million. The median price of all apartments also rose slightly from $1.18 million to $1.2 million this year.

• Largely due to big-ticket purchases near the southern end of Central Park, most notably at 220 Central Park South, total residential sales of units sold for more than $10 million are projected to reach $4.60 billion by the end of 2019, up from $4.235 billion in 2018.

• There was a small increase in the average price paid for an apartment in 2019, rising from $2.07 million to $2.12 million. The median price of all apartments also rose slightly from $1.18 million to $1.2 million this year.

• Largely due to big-ticket purchases near the southern end of Central Park, most notably at 220 Central Park South, total residential sales of units sold for more than $10 million are projected to reach $4.60 billion by the end of 2019, up from $4.235 billion in 2018.

• The average price of a condo in 2019 was $3.07 million ($1860 per square foot), up from $2.96 million in 2018 ($1809 per square foot). However, the condo median fell from $1.71M in 2018 to $1.695M this year.

• The average price paid for a co-op was $1.33 million, down from $1.38 million in the year prior. The median price of a co-op increased from $845K in 2018 to $850K this year.

• The average price paid for a co-op was $1.33 million, down from $1.38 million in the year prior. The median price of a co-op increased from $845K in 2018 to $850K this year.

NYC residential sales volume

NYC residential sales volume

• CityRealty projects that total co-op and condo sales volume will be approximately $21.2 billion for the full calendar year of 2019, based on the $19.9 billion recorded through November 30 and accounting for seasonality. The $21.2 billion projection is

slightly down from 2018 and substantially down from the total sales volume recorded in 2016 and 2017 which was $25.79 billion and $25.76 billion respectively.

CityRealty projects that there will be approximately 10,400 sales through the end of 2019, a decrease from 10,518 recorded in 2018 and substantially down from the decade highs of 16,571 in 2010 and 14,099 in 2013.

111 Murray Street in Tribeca is projected to be the third best-selling building of 2019 (Douglas Elliman)

111 Murray Street in Tribeca is projected to be the third best-selling building of 2019 (Douglas Elliman)

CityRealty projects that new development sales will reach roughly $5.8B through the end of 2019, an appreciable increase from the $5.3B of new development sales recorded in 2018 but a sizeable departure from 2017's $8.9B total spread across 1,848 sales. Through the end of 2019, approximately 1,225 new development sales are expected to be recorded through the end of 2019, compared to 1,108 last year.

While relatively flat this year and down from recent years, the average and median sales prices for all residential units in Manhattan—condos, condops, and co-ops—have increased significantly since 2008. This year's average apartment price of $2.12 million is 30% higher than in 2008. This year's median price of $1.2 million is 25% higher than it was in 2008.

The chart above illustrates the rise in sales of high-priced units over the past five years. With a projected sales volume of $21.2 billion, sales volume by dollar amount is down by 18% when compared to 2016's $25.8B in residential sales. Total sales of apartments over $10 million are projected to reach $4.6 billion through the end of 2019. However, the number of apartment sales in this price tier is down from 2016, when it was at $5.3 billion. The aggregate sales total for this market segment is on track to account for 22% of all dollars spent on Manhattan residential real estate this year, spread over a scant 221 sales.

In the third full year of Donald Trump’s presidency, the average sales price for the 11 Trump-branded condos in Manhattan once again fell below the Manhattan condo average. The average price paid for a Trump condo fell by 2% to $2.92M, just below Manhattan's $3.07M average. The average price per square foot in Trump condos increased by 2% to $1,720/ ft2 in 2019, just below the Manhattan condo

average of $1,860/ ft2.

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.