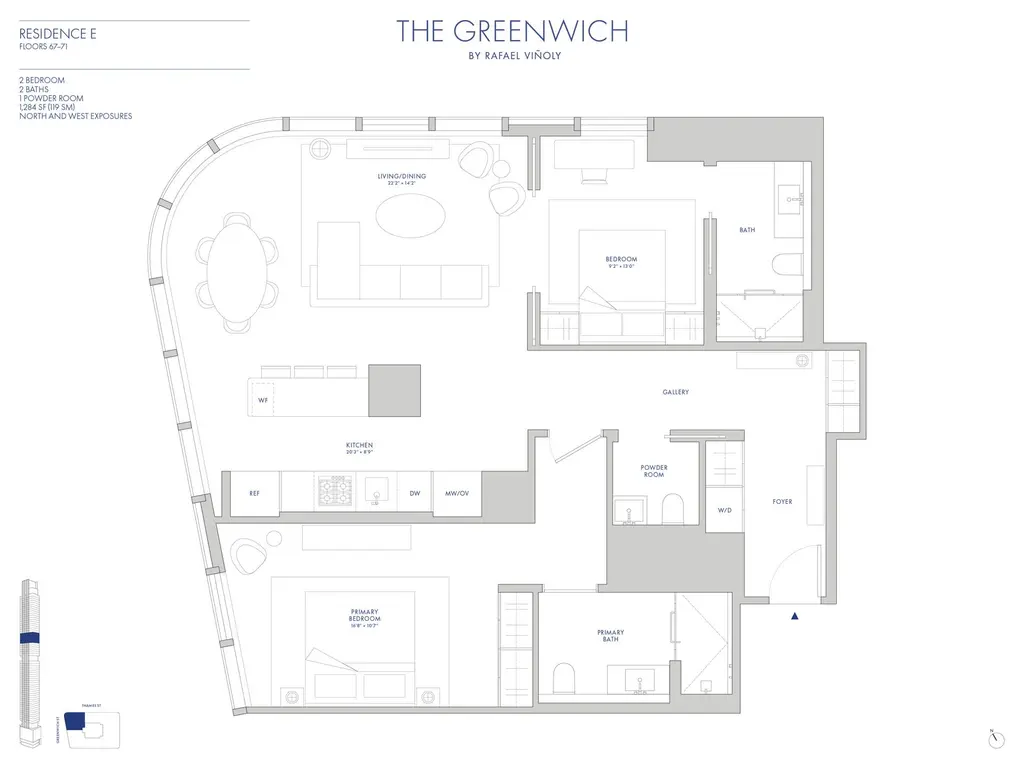

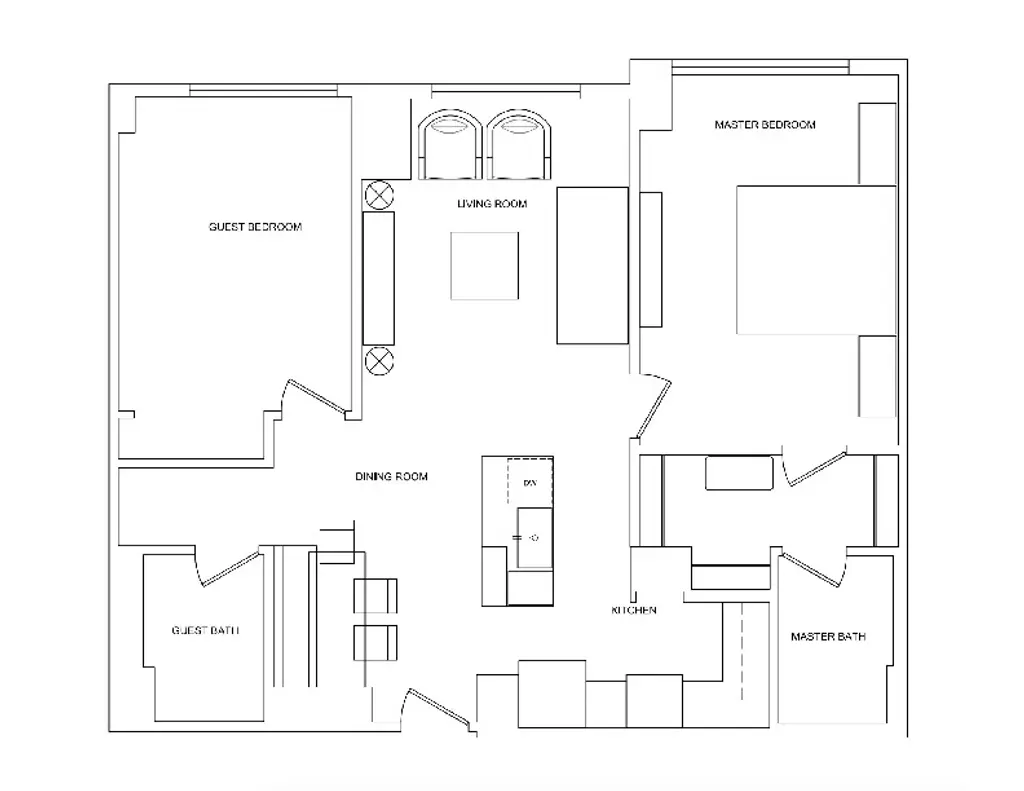

A split two-bedroom condo available at The Greenwich by Rafael Vinoly (Douglas Elliman)

A split two-bedroom condo available at The Greenwich by Rafael Vinoly (Douglas Elliman)

Today is Valentine’s Day, but some have already enjoyed celebrations: In the years since Parks and Recreation’s finale aired, the Emmy-nominated show’s legacy lives on through Galentine’s Day, a celebration of friendship on February 13 that has been embraced enthusiastically off the air. Sometimes it serves as a supplement to a celebration with a romantic partner on February 14, while the fun of the day is all other people need or want.

In this article:

“What’s Galentine’s Day? Oh, it’s only the best day of the year” – Parks and Recreation

As if to drive home the point that there is no traditional way to celebrate Galentine’s Day, a perfunctory Eventbrite search offered everything from group fitness classes to risque art events, from special restaurant menus to themed concerts taking place in New York on February 13, 2025. However, some make Galentine’s Day last all year by sharing an apartment with their friends.

The “roommate law” notwithstanding, it is fairly common practice for two or more friends to rent a New York apartment together. However, buying with friends is often approached with more trepidation than purchasing with a family member. And yet, with peer-to-peer funding showing no sign of slowing down, buying real estate with friends is not being completely ruled out.

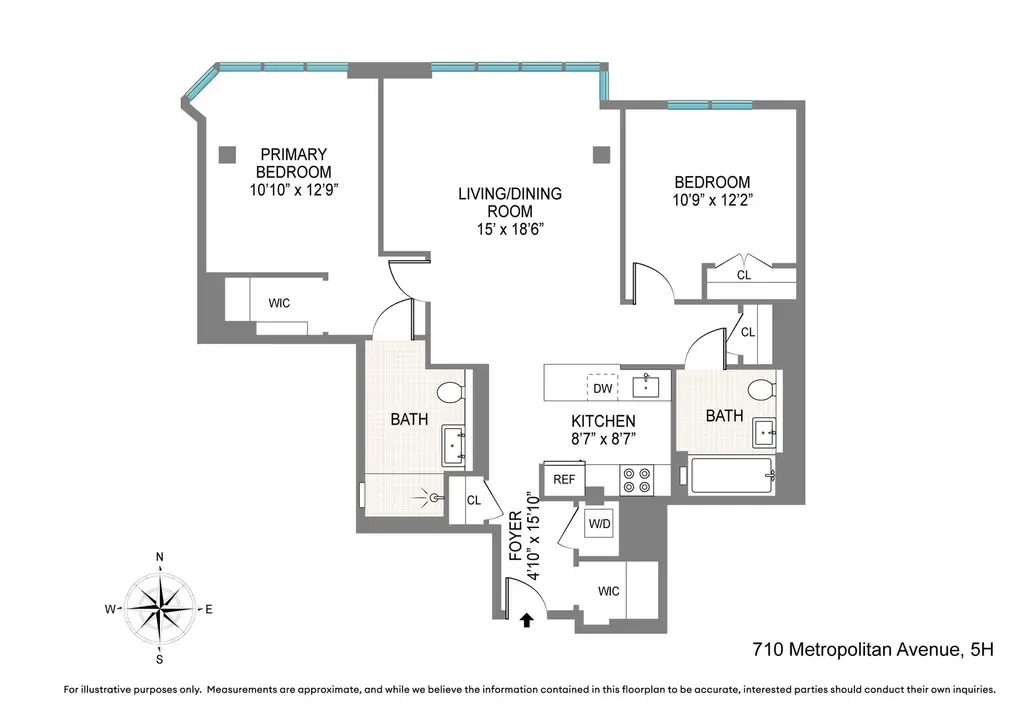

This article details when and how to do it and what to keep in mind during the process. We also look at units with split bedroom floor plans that allow for equal community and privacy.

This article details when and how to do it and what to keep in mind during the process. We also look at units with split bedroom floor plans that allow for equal community and privacy.

Turning to Friends for a Down Payment

If you want to establish a start-up, make a film, or engage in many other costly endeavors nowadays, you are just as likely to turn to your peers as you are to a bank. Although raising capital was once primarily carried out through formal lenders, it is now increasingly executed via peer-to-peer lending platforms. Whether one needs just a few thousand dollars or several million, the idea of turning to one’s peers for start-up funding has become the norm—especially for many Millennials—and the trend is increasingly impacting real estate deals too.

Compass agent Jake Velazquez has seen clients turning to friends for a range of reasons. “There’s a rising trend in the use of crowdfunding for real estate investments,” says Velazquez. “Groups of friends are also taking the same idea and pooling together their money and skills for investments. In some cases it works very well, since different people can take on different roles, and this can be more efficient.” Whether the deal involves a buyer turning to friends for help with a down payment or friends pooling resources to invest in a residential or commercial property, as peer-to-peer lending continues to move from a peripheral to a central funding strategy, it is also restructuring how buyers approach real estate investments. But is it wise to purchase with friends?

'Pre-nuptial Contracts' for Friend Co-owners

Most friends buying together don’t want to think about worst-case scenarios, but it is one of the most important things to consider when it comes to co-ownership. Indeed, like newlyweds who walk down the aisle with a pre-nuptial contract already inked, friends who buy together—even if they are driven by a desire for community rather than profit—are advised to prepare for the worst and hope for the best.

Compass agent Marina Schindler points out that while friends co-purchasing is on the rise today, there is a long history of friends buying properties together in New York City. “Many artist buildings in Soho and the East Village were purchased by friends, and these are now among some of the city’s most coveted spaces,” she points out. However, friends are coming together to buy apartments as well as buildings. Condos may be perceived as friendlier to this type of arrangement, but the consensus at Cooperator News is that a co-op board cannot discriminate against buyers based on marital status. Indeed, co-op attorney Andrew Freedland says, "This arrangement happened a lot before marriage equality, when gay couples wanted to purchase an apartment together. I don't see any reason two friends couldn't do it."

While Schindler is very optimistic about friends buying together and enjoys the community-building aspect of bringing friends together as owners, she notes that both of her current clients are working with attorneys to ensure their agreement is as tight as possible. “You really need to nail down all the possible worst-case scenarios,” she says, “What if the roof needs to be replaced? What if the basement floods? Who is responsible? The most important thing is having an internal agreement.” Freedland concurs, recommending a tenancy-in-common agreement outlining the distribution of tax benefits, inheritance rights, and what would happen to the apartment if one owner dies or wants to sell.

While Schindler is very optimistic about friends buying together and enjoys the community-building aspect of bringing friends together as owners, she notes that both of her current clients are working with attorneys to ensure their agreement is as tight as possible. “You really need to nail down all the possible worst-case scenarios,” she says, “What if the roof needs to be replaced? What if the basement floods? Who is responsible? The most important thing is having an internal agreement.” Freedland concurs, recommending a tenancy-in-common agreement outlining the distribution of tax benefits, inheritance rights, and what would happen to the apartment if one owner dies or wants to sell.

In November 2023, The New York Times ran a profile of three friends who purchased a multi-family Brooklyn townhouse where they would each have their own apartment, but would allow for communal living and group dinners. In doing so, they created an LLC with a 25-page operating agreement. This outlines three pools of money – one for a jointly held mortgage, one for repairs and improvements, and one for operations – and addresses how to manage disagreements and future developments (e.g., if someone gets married or wants to sell).

366 Bainbridge Street (Halstead Property)

366 Bainbridge Street (Halstead Property)

Buddying Up for a Vacation Home

While some friends team up to invest and others team up with the intention of purchasing a primary dwelling, for others, the goal is a shared second home. After all, even for some of the city’s more affluent buyers, a second house in the Hamptons may otherwise be out of reach.

Compass agent Cindy Scholz has worked with multiple sets of friends buying homes in the Hamptons and, by and large, she considers these co-purchasing arrangements to be a great option for people looking to buy a second home. “Co-purchasing is a great way to build equity while minimizing the upfront and ongoing costs of purchasing a home,” explains Scholz. But building equity is usually not the only or primary goal for these buyers: “My clients know the Hamptons is their destination of choice for the summer and are tired of someone else’s mortgage. Co-owning allows my clients to divide up the costs and responsibilities of a home while experiencing all the benefits. They are not overextended financially, allowing them to still take ski vacations and travel to other destinations in the off-season.”

Scholz also emphasizes that for many her clients, co-purchasing even represents a way to immediately increase their cash flow. “My clients often rent their homes for a portion of the summer and use the profits to take a trip elsewhere,” says Scholz, adding, “The Hamptons is prime for appreciation and ability to rent for ultra-prime prices. These conditions allow purchasers to choose between a long- and short-term hold—for co-purchasing, this flexibility is very appealing.”

“Keep things simple, be realistic, and don’t get discouraged. It’s easy for a group to persuade you to have unrealistic expectations—just stick to the numbers and make sure the team stays focused.”

To Buy with Friends or Not—That is the Question

While there are no guarantees, there are at least a few factors that appear to contribute to the success of friend co-investments. Scholz has observed that while the length of friendship prior to buying varies and doesn’t appear to be a major factor, her clients nearly always have “aligned interests, mutual friends and similar financials.” Velazquez has seen both good and bad deals among the friend groups with whom he has worked. His advice? “Keep things simple, be realistic, and don’t get discouraged. It’s easy for a group to persuade you to have unrealistic expectations—just stick to the numbers and make sure the team stays focused.” Schindler agrees that co-purchasing can be a great way to buy into the city’s real estate market but adds, “it is also crucial to have completely honest communication between both parties.”

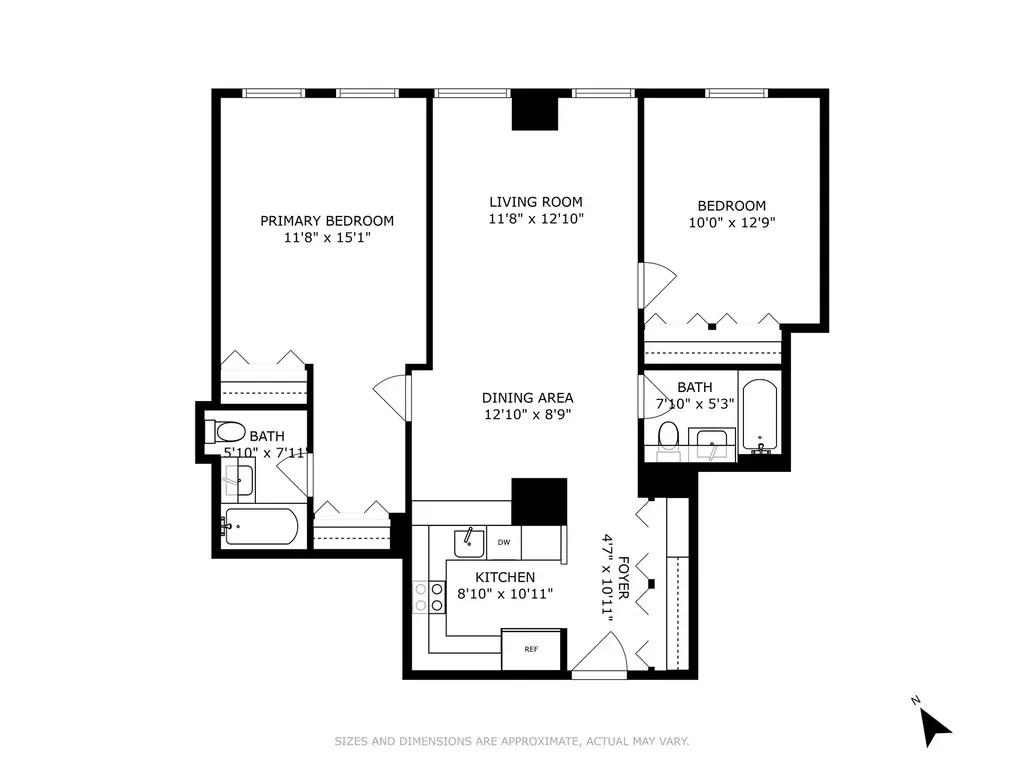

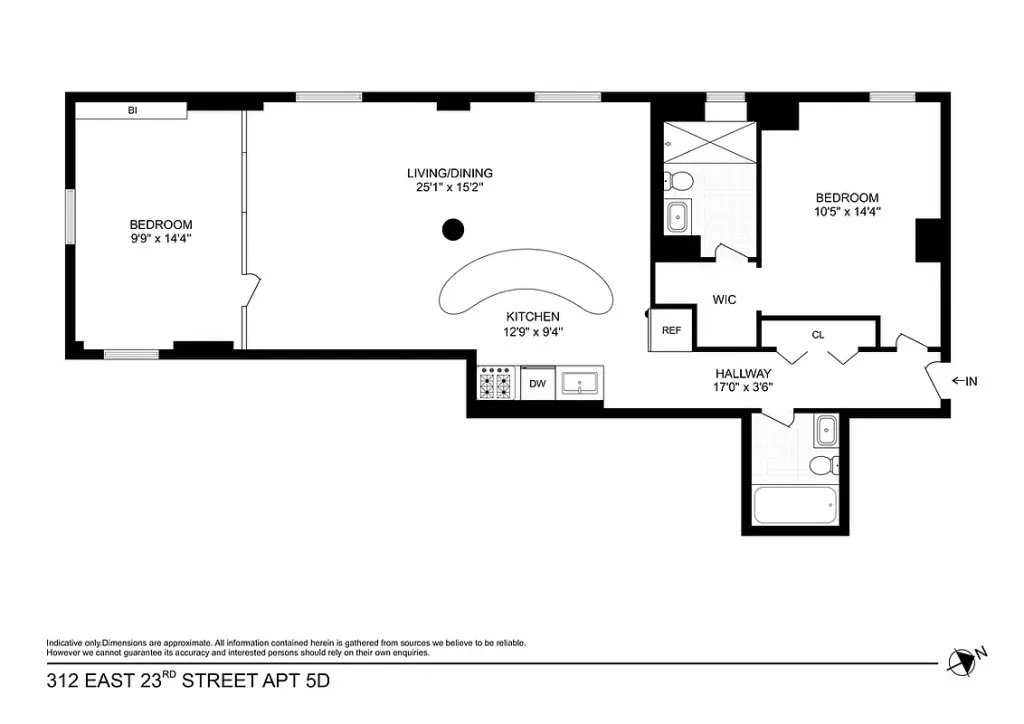

Listings with split layouts great for co-purchasers

Financial District and Downtown

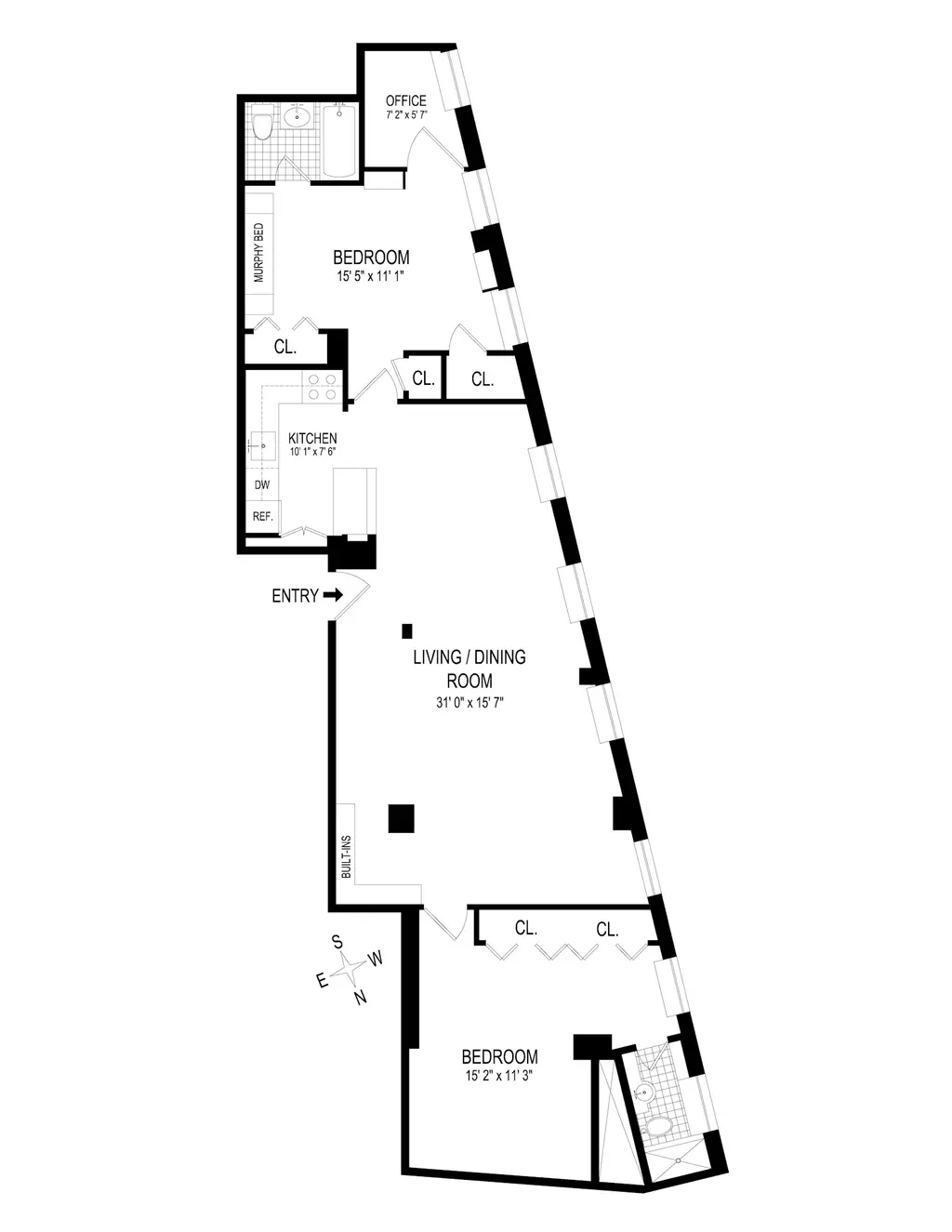

149 Sullivan Street, #4C (Douglas Elliman Real Estate)

South Star, #5G (Douglas Elliman Real Estate)

The Foundry, #5D (Compass)

139 Bowery, #7A (Coldwell Banker Warburg)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

The Ascot, #17A (Coldwell Banker Warburg)

One Wall Street, #613 (Douglas Elliman Real Estate)

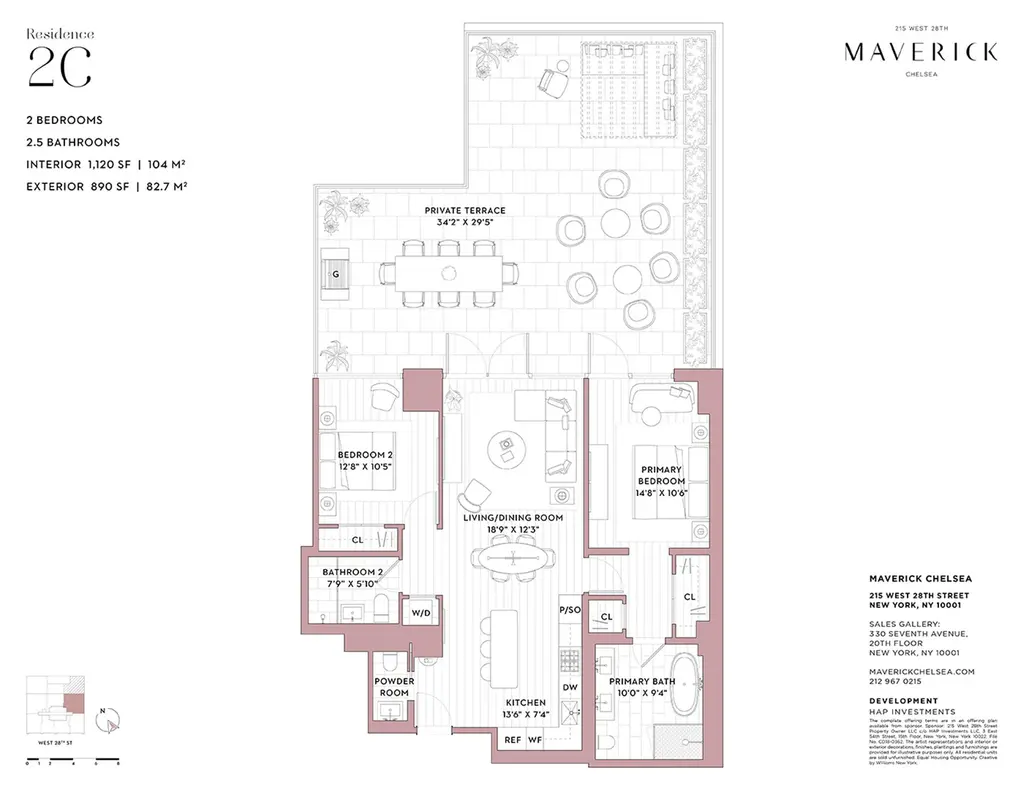

Maverick, #2C (Douglas Elliman Real Estate)

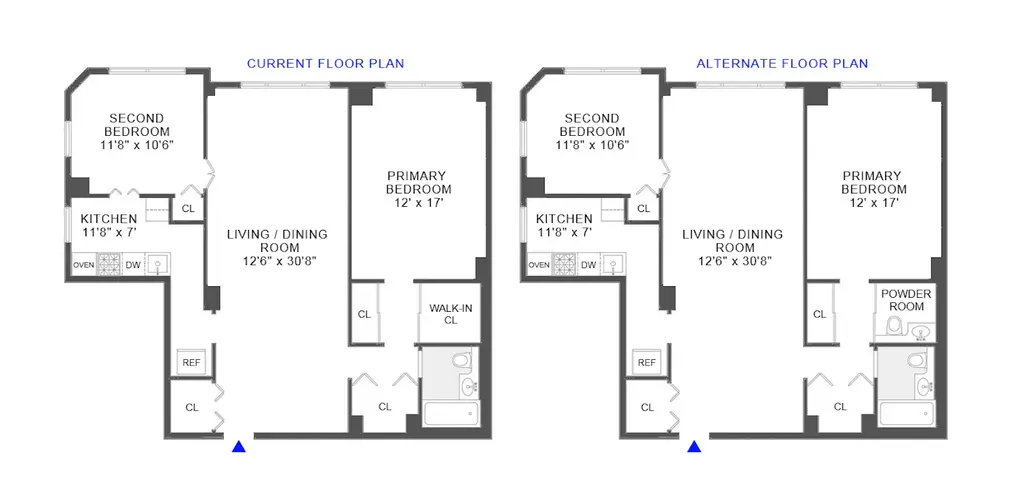

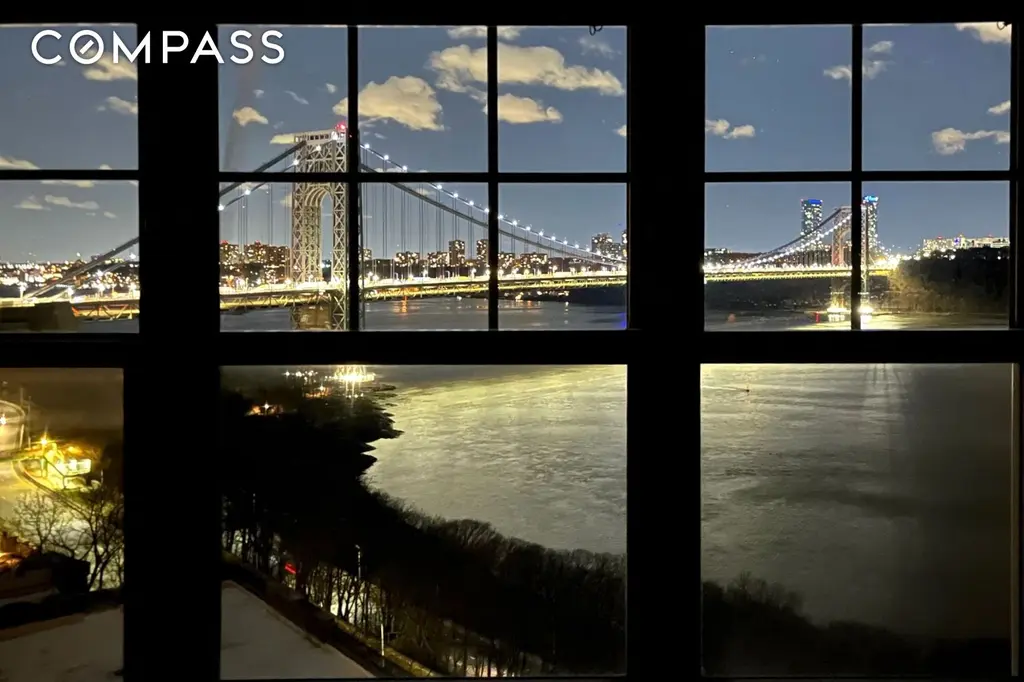

The Greenwich by Rafael Vinoly, #68E

$3,000,000

Financial District | Condominium | 2 Bedrooms, 2.5 Baths | 1,284 ft2

The Greenwich by Rafael Vinoly, #68E (Douglas Elliman Real Estate)

Midtown

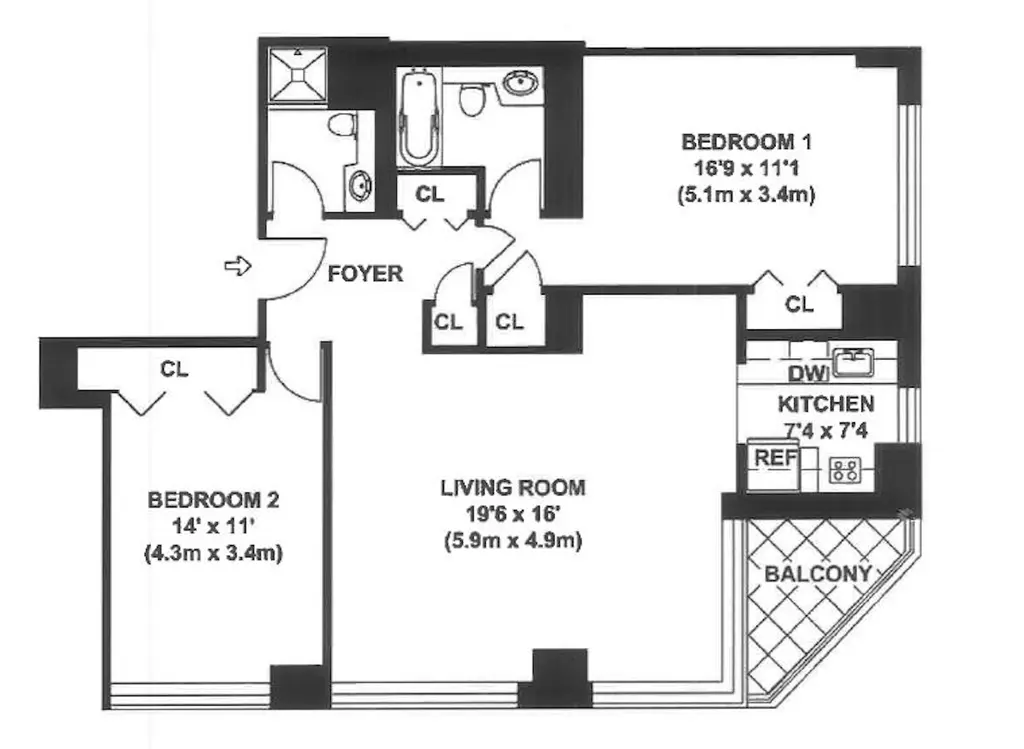

The Club at Turtle Bay, #25E

$1,295,000

Turtle Bay/United Nations | Condominium | 2 Bedrooms, 2 Baths | 1,040 ft2

The Club at Turtle Bay, #25E (Brown Harris Stevens Residential Sales LLC)

The West Residence Club, #302 (Corcoran Sunshine Marketing Group)

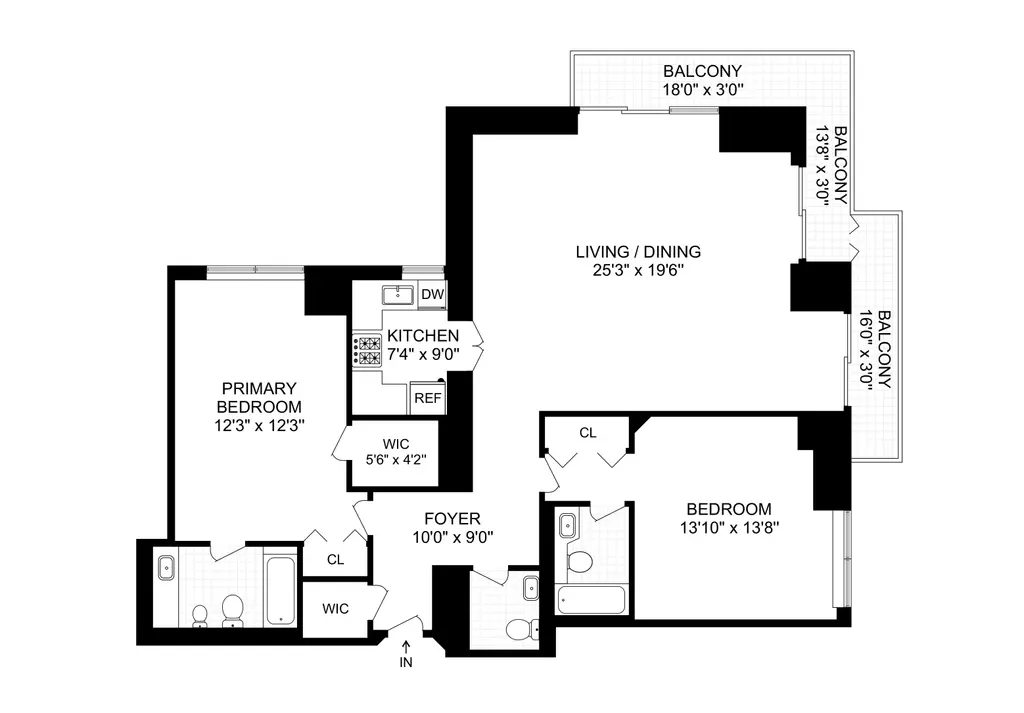

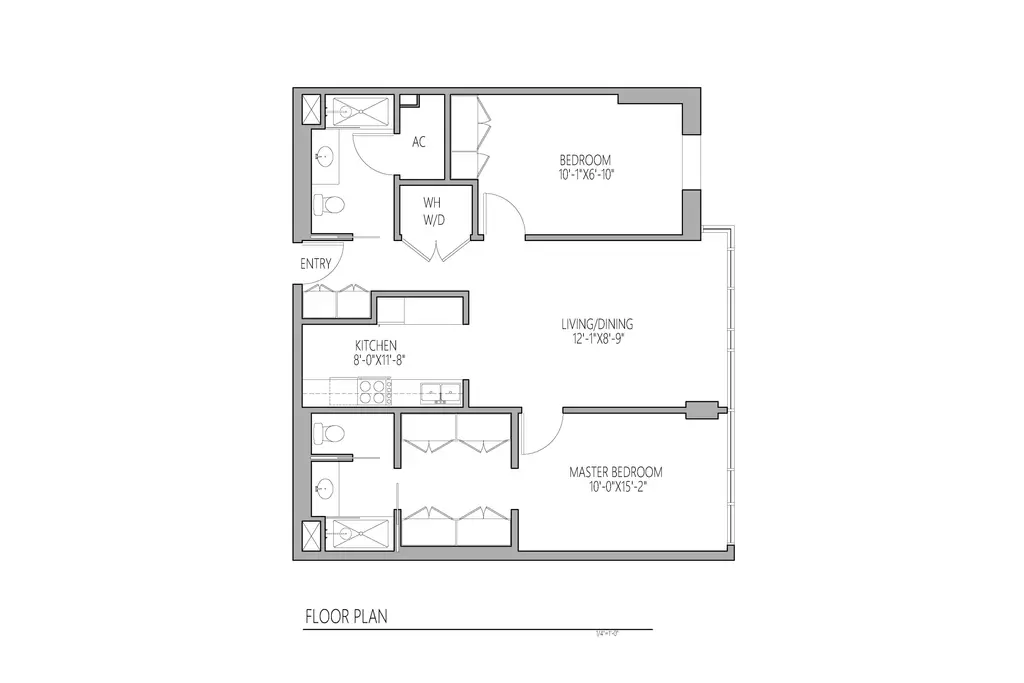

100 United Nations Plaza, #8A

$1,500,000

Turtle Bay/United Nations | Condominium | 2 Bedrooms, 2.5 Baths | 1,327 ft2

100 United Nations Plaza, #8A (Compass)

Tower 53, #16E (Compass)

The Orion, #20G (Compass)

100 United Nations Plaza, #7G

$1,595,000

Turtle Bay/United Nations | Condominium | 2 Bedrooms, 2.5 Baths | 1,256 ft2

100 United Nations Plaza, #7G (Corcoran Group)

Upper East Side - Upper West Side

East River House, #8C (Brown Harris Stevens Residential Sales LLC)

The Opera, #20A (Brown Harris Stevens Residential Sales LLC)

The Savoy, #24D (Compass)

Upper Manhattan

1400 on Fifth, #6K (Compass)

Castle Village, #61 (Compass)

Parc North, #6B (Real New York)

Brooklyn and Queens

500 Fourth Avenue, #3M (Douglas Elliman Real Estate)

Oosten, #503 (Sothebys International Realty)

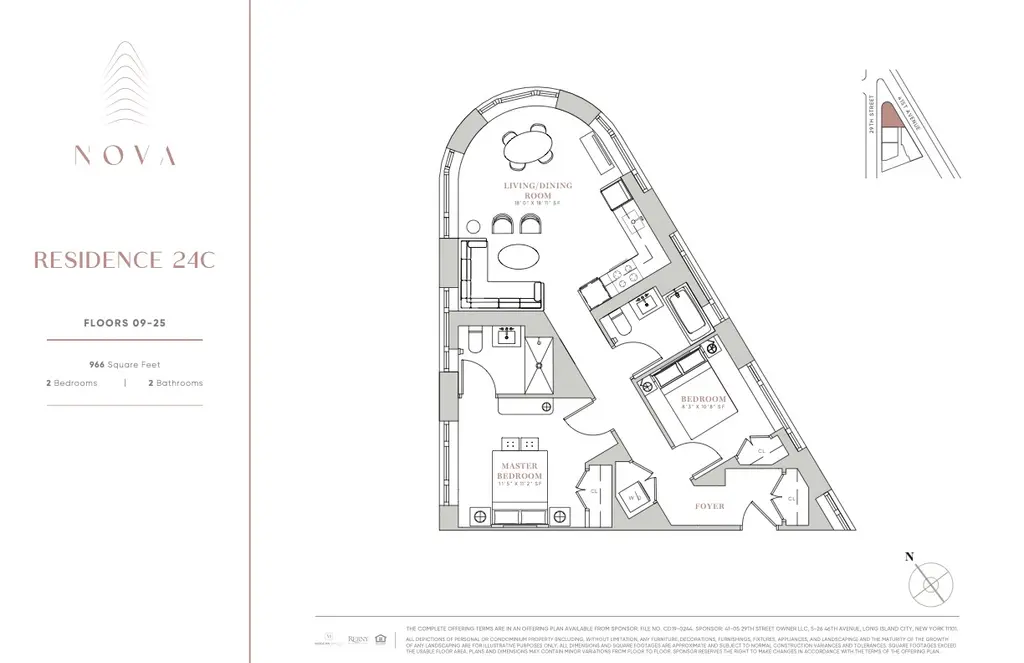

NOVA, #24C (Elika Associates II LLC)

Umbrella Factory, #5H (Douglas Elliman Real Estate)

Austin Nichols House, #A602 (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.