Jackson Heights apartments that are 100% owner-occupied

Jackson Heights apartments that are 100% owner-occupied

When a coop or condo is being appraised, one of the many factors that appraisers consider is the property’s owner-occupied rate. On the surface, this may seem like an insult to renters, but in fact, the owner-occupied rate has less to do with people than it does with economics. This article explores why lower owner-occupied rates tend to negatively impact property values and limit financing options.

In this article:

The owner-occupied rate’s impact on property values

As a rule, most coops try to ensure that no more than a third of units are non-owner-occupied since going above this rate typically negatively impacts property values. Some coops in New York City have even higher thresholds and aim to have no more than 10 percent of non-owner-occupied units in the building. But why does the number of owners versus renters matter? One factor is the assumption that the culture of primarily renter-occupied versus owner-occupied buildings differs because owners tend to be more invested in their buildings and be less transient, though this isn't always true. The real reason why buildings try to avoid a low owner-occupied rate is that it negatively impacts financing options, both for individual buyers and the coop itself.The owner-occupied rate’s impact on financing

First, the owner-occupied rate impacts eligibility for some mortgage programs and financing. For example, with few exceptions, the Federal Housing Administration (FHA) will only finance mortgages in buildings where at least 50 percent of the units are owner-occupied. In New York City, this generally isn't a concern since few properties or buyers even qualify for FHA loans. However, like the FHA, most private lenders are also wary of lending to buyers looking to purchase in a building with a low owner-occupied rate. Lenders who are willing to work with buyers under these circumstances also tend to have additional restrictions (e.g., if a building is more than one-third non-owner-occupied, many lenders will only offer financing at 50 to 70 percent rather than 80 percent).Second, it is worth noting that prospective buyers aren't the only people impacted by lending rules that restrict financing in buildings with higher-than-average non-owner-occupied units. When sellers put their units on the market, the same rules will restrict the number of potential buyers, which may drive down the overall value of their property.

Finally, buildings can also face challenges securing lending when they have a high non-owner-occupied rate. Interestingly, the problem isn't that renters are viewed as less credit-worthy than owners but rather that lenders prefer not to lend to buildings if the original sponsor or any other individual owner owns a high number of units. Notably, this can be a problem if the building requires financing (e.g., to complete a necessary capital project). That said, if the coop or condo has solid financials, this may or may not be a factor.

Finally, buildings can also face challenges securing lending when they have a high non-owner-occupied rate. Interestingly, the problem isn't that renters are viewed as less credit-worthy than owners but rather that lenders prefer not to lend to buildings if the original sponsor or any other individual owner owns a high number of units. Notably, this can be a problem if the building requires financing (e.g., to complete a necessary capital project). That said, if the coop or condo has solid financials, this may or may not be a factor.

Roosevelt Terrace, 35-31 85th Street, #8J

$600,000

Jackson Heights | Cooperative | 3 Bedrooms, 1 Bath | 1,050 ft2

35-31 85th Street, #8J (Compass)

The owner-occupied rate’s impact in coops versus condos

In some cases, the owner-occupied rate matters in both coops and condos. For example, FHA restrictions, which generally restrict financing to buildings where at least 50 percent of units are owner-occupied, apply to coops and condos. However, in New York City, where many condo developments are launched with an expectation that investors will purchase most of the units, the owner-occupied rate is only sometimes a concern for private lenders.Unfortunately, the same perspective doesn't hold for coops, where the owner-occupied rate typically has a more significant impact on the perceived creditworthiness of the building and the value of the building's units. Coincidentally, this is also one of the reasons why New York City coops are far more likely than condos to restrict subletting (e.g., to ban it outright or only extend the privilege to owners who have occupied their units for two years or longer).

The intangible value of buildings with a mix of owner- and renter-occupied units

While conventional wisdom suggests it is better to buy in a building with more owner-occupied units, this still may or may not be true. It's no secret that in New York City, it is challenging for many people to buy. It's also no secret that age, occupation, and even race and ethnicity have an impact on one's likelihood of owning their own apartment. If you value living in a less homogenous building, a building with a more generous balance of owner and non-owner-occupied units may still be preferable.

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Active NYC listings with a strict subletting policy

Park Ten, #6KA (Corcoran Group)

650 Park Avenue, #2F

$2,500,000

Park/Fifth Ave. to 79th St. | Cooperative | 3 Bedrooms, 4 Baths | 2,150 ft2

650 Park Avenue, #2F (Living New York)

333 East 53rd Street, #3KL (Sothebys International Realty)

Connaught Tower, #32A (Brown Harris Stevens Residential Sales LLC)

18 West 90th Street, #C (Brown Harris Stevens Residential Sales LLC)

36 Sutton Place South, #11D (Compass)

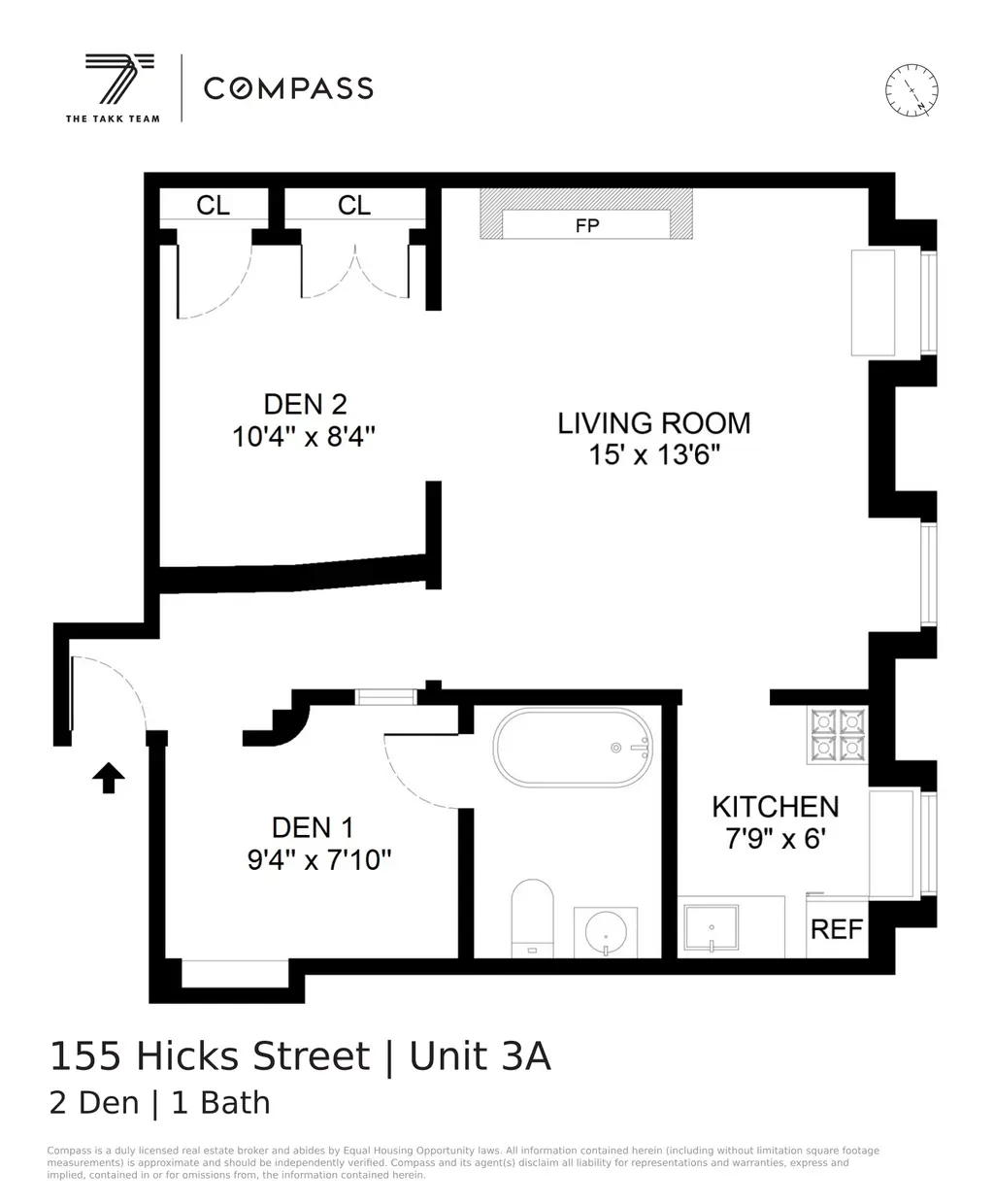

155 Hicks Street, #3A (Compass)

The Allendale, #1J (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.