What do TV actors, empty nesters in the tristate area, domestic and international business executives, and international investors have in common? They are the most likely to be in the market for a second home, or pied-a-terre, in New York City. People who need or want to be in New York on a regular basis need a place to stay, and a second home is more personal and less costly than a hotel. It also serves as an investment when the owner isn’t in it.

Such has typically been the case, but pied-a-terre apartments have become increasingly popular in recent years. After the borders reopened following the pandemic-induced lockdown, agents saw a wave of interest from international buyers seeking both a second home and a smart investment. They also cannot help but become more appealing in the wake of New York’s legislation targeting the short-term rentals some visitors might have relied on in the past.

In this article:

Whether coming from the state or the country of Georgia, this article is an introduction for those looking to purchase a New York City apartment to be lived in on a part-time basis. We also look at newly renovated apartments in buildings allowing pied-a-terre buyers.

Pied-a-terre: What is it?

The literal translation of “pied-a-terre” from French is “foot on the ground.” In the world of New York real estate, the term refers to an apartment that a resident only lives in part-time and is categorized as a “non-primary residence.” There is no legal definition of this type of apartment, but former New York City Finance Commissioner Martha Stark says a unit is considered a pied-a-terre if it’s not owned in an individual’s name or if the owner is not receiving a residents-only tax benefit from the city.

Pied-a-terre apartments may be found in all types of buildings, but two clear categories have emerged over the years. One is for apartments with low sticker prices but few bells and whistles — e.g., studios in Tudor City with Murphy beds and kitchenettes with mini-fridges and microwave convection ovens, as opposed to full kitchens. (Though if the point of the New York visit is to try city restaurants, this may not matter.)

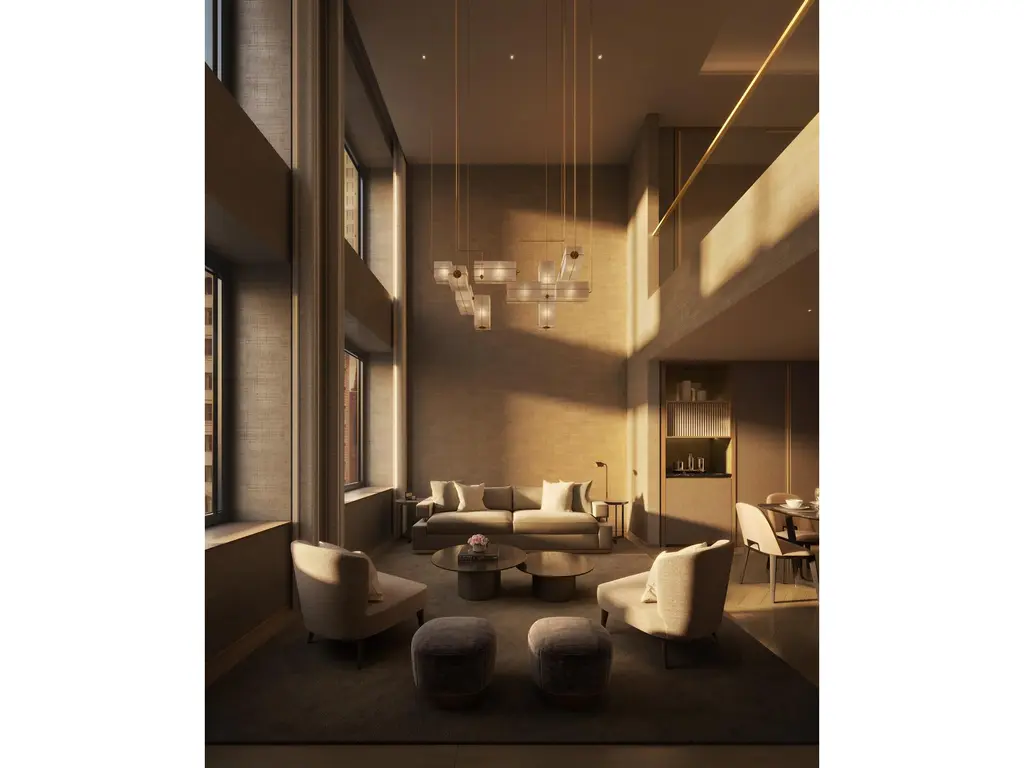

At the opposite end of the market, a new class of luxury condominiums with an array of amenities and coveted addresses has sprung up in recent years. These offer the atmosphere of a luxury hotel, and some are indeed located in New York City hotels (e.g., The Plaza, The Ritz-Carlton Residences New York NoMad, and the forthcoming Surrey Residences). Such apartments have proven popular among wealthy foreign buyers, but domestic buyers also appreciate the level of luxury and service.

Condo vs. Co-op + What the board needs to know

In general, cooperatives put forth much stricter rules about pied-a-terres than condominiums; some co-op boards ban them altogether, others allow them only on a case-by-case basis, and a few buildings do allow them. Either way, the building will often state up front what the pied-a-terre policies are.

Even if one is able to find a pied-a-terre co-op, this purchase requires a full board process and interview with the board. Buyers should be prepared to do due diligence before putting in an offer, and be prepared to be clear about their intended pied-a-terre use. Co-op boards will want to know how often the buyer will be there, who will have access to the apartment when the buyer's away, and any plans for home businesses or renovations.

Condos, on the other hand, offer a hassle-free purchasing process. Because condo buildings don’t designate if they are pied-a-terre friendly or not, pretty much any building is fair game. The only criterion that usually needs to be met by the potential buyer is verified financials.

Even if one is able to find a pied-a-terre co-op, this purchase requires a full board process and interview with the board. Buyers should be prepared to do due diligence before putting in an offer, and be prepared to be clear about their intended pied-a-terre use. Co-op boards will want to know how often the buyer will be there, who will have access to the apartment when the buyer's away, and any plans for home businesses or renovations.

Condos, on the other hand, offer a hassle-free purchasing process. Because condo buildings don’t designate if they are pied-a-terre friendly or not, pretty much any building is fair game. The only criterion that usually needs to be met by the potential buyer is verified financials.

Renting out a pied-a-terre

Both condos and co-ops typically set forth rules about renting out pied-a-terres while the buyer isn’t occupying it. While rules are particular to each building, subletting rules often require that a renter has to be there for one year minimum. Co-ops typically restrict the length of time an apartment can be rented out to one to two years within a five- to seven-year period. Finally, many buildings don’t allow guests other than immediate family to live there.

Many of the hotels offering a pied-a-terre component have another alternative for when the owner is not in town: These owners may elect to release the unit to the hotel’s management, which will lease out and manage the apartments on their behalf when they aren’t in town. This business model offers owners some peace of mind.

Financing

It should be noted that nabbing financing for a pied-a-terre can be a tricky proposition. If it’s a second home, pied-a-terres must be at least 60 miles away from the buyer’s primary residence for them to secure a fixed rate loan. Moreover, banks will often charge higher interest rates because the apartment is not a primary residence.

Taxes

Beyond the listing price, pied-a-terre buyers should be aware of property taxes, which have emerged as a hot-button issue among New York City and State legislators in recent years. Unlike the mansion tax, which is a one-time payment at closing, some officials have called for a high annual tax on secondary residents. Proponents see it as a way to generate funds for the city's transportation and infrastructure systems; opponents argue that it would punish luxury buyers and drive them out of state.

It remains to be seen what will happen with this — for all the times it has been introduced and debated, it has yet to be enacted. However, one tax has always been on the books: If you own a property in New York State and spend 183 or more days in the state (say, at your Manhattan pied-a-terre), you are considered a resident of the state and must pay an income tax.

It remains to be seen what will happen with this — for all the times it has been introduced and debated, it has yet to be enacted. However, one tax has always been on the books: If you own a property in New York State and spend 183 or more days in the state (say, at your Manhattan pied-a-terre), you are considered a resident of the state and must pay an income tax.

Pied-a-terre-friendly listings

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Upper East Side/Upper West Side

150 East 61st Street, #8B (Compass)

308 East 79th Street, #1G (Brown Harris Stevens Residential Sales LLC)

315 East 68th Street, #12C (Corcoran Group)

Majestic Towers, #5A (The Agency Brokerage)

The Imperial, #ONED (Compass)

One Central Park, #61G

$5,600,000

Central Park West | Condominium | 2 Bedrooms, 2.5 Baths | 1,595 ft2

One Central Park, #61G (Douglas Elliman Real Estate)

One Central Park West, #25C

$6,250,000

Central Park West | Condominium | 2 Bedrooms, 3 Baths | 1,591 ft2

One Central Park West, #25C (Coldwell Banker Warburg)

Midtown

155 East 49th Street, #10D (Coldwell Banker Warburg)

Tudor Tower, #1623 (Corcoran Group)

Woodstock Tower, #3010 (Compass)

Museum Tower, #18H (Brown Harris Stevens Residential Sales LLC)

Mandarin Oriental Residences Fifth Avenue, #7B

$4,900,000

Midtown East | Condominium | 1 Bedroom, 1.5 Baths | 1,347 ft2

Mandarin Oriental Residences Fifth Avenue, #7B (Douglas Elliman Real Estate)

The Plaza, #1623 (Brown Harris Stevens Residential Sales LLC)

The Towers of the Waldorf Astoria, #2910

$6,050,000

Midtown East | Condominium | 2 Bedrooms, 2.5 Baths | 1,705 ft2

The Towers of the Waldorf Astoria, #2910 (Douglas Elliman Real Estate)

Downtown

54 East 8th Street, #6R (Compass)

The Madison Parq, #4E (Corcoran Group)

The Dominick, #2205 (Corcoran Group)

The Victoria, #1229 (Compass)

Gramercy Towers, #5H (Douglas Elliman Real Estate)

Chelsea Gardens, #3GE (Sothebys International Realty)

The Ritz-Carlton Residences, New York, NoMad, #PH40B

$3,450,000

Chelsea | Condominium | 1 Bedroom, 1.5 Baths | 911 ft2

The Ritz-Carlton Residences, New York, NoMad, #PH40B (Keller Williams NYC)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.