Zeckendorf Towers, #V7K

Zeckendorf Towers, #V7K

With affordability becoming a growing problem for buyers in New York City and nationwide, first-time buyers are eager to find creative workarounds. One obvious solution is to secure a personal investor. While there are obvious advantages to purchasing a residential property with the financial support of a family member or friend who is willing to invest, it is important to understand the advantages, disadvantages, and complications of pursuing this pathway to home ownership.

In this article:

Why and when to purchase a property with a personal investor

According to the Worldwide Cost of Living Index, New York City was North America's most expensive city and just behind Singapore and Geneva for the most expensive in the world in 2023. High housing costs, including exceptionally high rental fees, are largely to blame for the city’s sky-high cost of living. As a result, saving money for a down payment is difficult and even impossible for many New Yorkers, even those with incomes well above the national average. Given that owning and renting often result in similar monthly costs, however, for many New Yorkers, the only obstacle to owning is coming up with a down payment. One way to overcome this obstacle is to find an investor (e.g., a family or friend who can provide or contribute to the down payment).The advantage of buying a property with a personal investor is simple. Whether you get a loan for a down payment from a private lender, an elderly uncle, or a wealthy best friend, the loan will negatively impact your debt-to-credit ratio and typically will make you ineligible for further financing. By contrast, if you find an investor, the arrangement won’t impact your debt-to-credit ratio because you won’t owe money to the lender, but this decision comes with conditions. Rather than own 100 percent of your property, you’ll only own only a fraction of your own home. For example, if your personal investor agrees to invest $300,000 and you’re purchasing a property for $900,000, depending on how you take title, you’ll only own two-thirds of the property. In essence, you’ll be co-owners with your investor until you eventually both agree to sell the property and move on, and this can present complications.

The potential challenges of co-ownership

Despite the many advantages of buying a property with a personal investor, the arrangement can make financing, owning, and even selling a property far more challenging.Financing

If you're buying with an investor, you and your investor will both need to be approved for the mortgage. This naturally means that you'll both need to be creditworthy, which will likely create a more complex and lengthy approval process. In addition, you'll both be responsible for ensuring the mortgage is paid on a regular basis, even if you yourself have agreed to pay down the mortgage as part of the deal. Finally, if you do end up defaulting on the mortgage, you'll negatively impact not only your credit rating but also your personal investor's credit rating. It goes without saying that in order to enter into this type of arrangement, you'll need a high level of trust with your investor. Even if you do have a high-trust relationship, however, it never hurts to seek legal counsel before proceeding.

There is a lot of paperwork involved in buying a home to begin with, and working with an investor will lead to more. (Pexels - Andrea Piacquadio)

There is a lot of paperwork involved in buying a home to begin with, and working with an investor will lead to more. (Pexels - Andrea Piacquadio)

Taking title

If you buy a property with a personal investor, before you close, you’ll also need to decide how to hold the title. If you and your investor own unequal shares in the property, you'll likely pursue what is known as "tenancy in common.” Tenancy in common allocates homeownership percentages based on how much each of you has invested. As a result, if, for example, Uncle Ed agrees to invest one-third, and you've agreed to pay down the remaining mortgage, you can opt to split the tenancy along these lines, with Uncle Ed owning one-third of the shares and you owing the remaining shares. However, under this arrangement, there are some restrictions. Most notably, you’ll never be able to sell the property (or your shares in the property) without getting Uncle Ed’s permission first.

Another option is known as “joint tenancy.” In this case, ownership is equal, even if the initial investment in the property wasn’t equal. As a result, even if Uncle Ed helped you out by giving you one-third of the property's value, and you agree to pay down the remaining mortgage, Uncle Ed will still own half of the property. Another caveat is that if you opt for joint tenancy, you will forfeit the right to choose a beneficiary for your share of the property since the shares will automatically be transferred to your co-owner, Uncle Ed.

While you may not mind this arrangement now, what if your circumstances change? For example, let's say, you team up with your uncle (or any other family or friend) to buy a property while single and you suddenly pass away while living in the property with a partner or spouse. If this happens, Uncle Ed (or whoever you chose as your investor) will automatically inherit your shares in the property, leaving your partner or spouse with no automatic claim to the shares, and if your investor wants to sell, nor guaranteed right to continue living in the property.

If you buy a property with a personal investor, before you close, you’ll also need to decide how to hold the title. If you and your investor own unequal shares in the property, you'll likely pursue what is known as "tenancy in common.” Tenancy in common allocates homeownership percentages based on how much each of you has invested. As a result, if, for example, Uncle Ed agrees to invest one-third, and you've agreed to pay down the remaining mortgage, you can opt to split the tenancy along these lines, with Uncle Ed owning one-third of the shares and you owing the remaining shares. However, under this arrangement, there are some restrictions. Most notably, you’ll never be able to sell the property (or your shares in the property) without getting Uncle Ed’s permission first.

Another option is known as “joint tenancy.” In this case, ownership is equal, even if the initial investment in the property wasn’t equal. As a result, even if Uncle Ed helped you out by giving you one-third of the property's value, and you agree to pay down the remaining mortgage, Uncle Ed will still own half of the property. Another caveat is that if you opt for joint tenancy, you will forfeit the right to choose a beneficiary for your share of the property since the shares will automatically be transferred to your co-owner, Uncle Ed.

While you may not mind this arrangement now, what if your circumstances change? For example, let's say, you team up with your uncle (or any other family or friend) to buy a property while single and you suddenly pass away while living in the property with a partner or spouse. If this happens, Uncle Ed (or whoever you chose as your investor) will automatically inherit your shares in the property, leaving your partner or spouse with no automatic claim to the shares, and if your investor wants to sell, nor guaranteed right to continue living in the property.

An investor can put apartments like this within reach, but read this first. (41 Spring Street, #4BR - Douglas Elliman)

An investor can put apartments like this within reach, but read this first. (41 Spring Street, #4BR - Douglas Elliman)

Gaining Coop Board Approval

For anyone looking to purchase with an investor in a coop, other obstacles are also likely. First, coops carefully scrutinize potential buyers’ finances. In most cases, the need to rely on a personal investor will be viewed as a red flag. After all, boards are looking for buyers who are already credit-worthy, so any sign that a buyer might struggle to save money and, as a result, pay their fees on a timely basis is likely to pose a problem.

In addition, buying a coop with an investor would represent a highly atypical transaction. When you buy a coop, you’re not buying real estate per se but rather shares in a property with the right to lease a specific unit. In this case, you would be asking a coop board to agree to let you co-own shares with an investor, which raises a host of legal questions. Coop shareholders are typically residents who live in the building or, in some cases, investors who own multiple units that they, in turn, rent out, but either way, they are invested in the building.

An investor without a personal stake in the building and coop community, therefore, poses a dilemma. In coops, shareholders get to vote on matters that impact the coop’s finances and the building and its community, but why would they extend this to a personal investor with no real connections to the building? While some coop boards may still approve an application from a buyer working with a personal investor, there is little doubt that the closing would take much longer and result in substantially higher legal fees.

For anyone looking to purchase with an investor in a coop, other obstacles are also likely. First, coops carefully scrutinize potential buyers’ finances. In most cases, the need to rely on a personal investor will be viewed as a red flag. After all, boards are looking for buyers who are already credit-worthy, so any sign that a buyer might struggle to save money and, as a result, pay their fees on a timely basis is likely to pose a problem.

In addition, buying a coop with an investor would represent a highly atypical transaction. When you buy a coop, you’re not buying real estate per se but rather shares in a property with the right to lease a specific unit. In this case, you would be asking a coop board to agree to let you co-own shares with an investor, which raises a host of legal questions. Coop shareholders are typically residents who live in the building or, in some cases, investors who own multiple units that they, in turn, rent out, but either way, they are invested in the building.

An investor without a personal stake in the building and coop community, therefore, poses a dilemma. In coops, shareholders get to vote on matters that impact the coop’s finances and the building and its community, but why would they extend this to a personal investor with no real connections to the building? While some coop boards may still approve an application from a buyer working with a personal investor, there is little doubt that the closing would take much longer and result in substantially higher legal fees.

Certain coops explicitly do not allow purchases with investors. However, while some market-rate coops are willing to work with buyers who come in with an investor, this arrangement would likely be impossible if you were looking to buy an Housing Development Fund Corporation (HDFC) unit. HDFCs are unique for several reasons, including the fact that they restrict the sale of units to buyers who make less than certain income thresholds. In most cases, buyers must earn at most 165 percent of the area median income (AMI). In some HDFCs, the cap is 120 percent of the AMI. As such, it seems unlikely that most HDFCs would consider someone buying with an investor because, in most cases, the combined income would render the buyer ineligible by default.

Refinancing and selling the property

A final and important consideration regards refinancing and selling a property purchased with an investor. Homeowners often use their home equity to finance upgrades (e.g., major renovations), consolidate debt, or cover other significant expenses (e.g., a child's post-secondary education). The advantage of applying for a Home Equality Line of Credit (HELOC) is that these loans typically offer more attractive interest rates than other types of loans. If you have an investor and co-own your property, however, you’ll always have to get their permission before using your home equity to finance other expenses.

In addition to restricting your ability to leverage your home equity, selling a co-owned property can also be complicated. If you've opted for tenancy in common, you'll never be able to sell the property without your investor's permission. Tenancy in common can also pose potential challenges in the event that your investor passes away. After all, unless they've already designated you as a beneficiary, their shares will likely be inherited by a third party (their designated beneficiary), and this person may or may not be someone with whom you're comfortable co-owning a property.

A final and important consideration regards refinancing and selling a property purchased with an investor. Homeowners often use their home equity to finance upgrades (e.g., major renovations), consolidate debt, or cover other significant expenses (e.g., a child's post-secondary education). The advantage of applying for a Home Equality Line of Credit (HELOC) is that these loans typically offer more attractive interest rates than other types of loans. If you have an investor and co-own your property, however, you’ll always have to get their permission before using your home equity to finance other expenses.

In addition to restricting your ability to leverage your home equity, selling a co-owned property can also be complicated. If you've opted for tenancy in common, you'll never be able to sell the property without your investor's permission. Tenancy in common can also pose potential challenges in the event that your investor passes away. After all, unless they've already designated you as a beneficiary, their shares will likely be inherited by a third party (their designated beneficiary), and this person may or may not be someone with whom you're comfortable co-owning a property.

The bottom line is that buying a property with the help of an investor such as a parent, relative, or even close friend can be a great way to break in to the housing market, especially in New York City, where even modest properties often require buyers to come to the table with up to $200,000. At the same time, buying with an investor, even someone you already trust, is a complicated, long-term arrangement.

Investor-friendly listings

416 East 83rd Street, #1C

$315,000 (-3.1%)

Yorkville | Cooperative | Studio, 1 Bath

416 East 83rd Street, #1C (Douglas Elliman Real Estate)

1173 Rogers Avenue, #6D (Corcoran Group)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

160 East 27th Street, #12E (Compass)

12 East 75th Street, #4F

$849,000 (-12.9%)

Park/Fifth Ave. to 79th St. | Cooperative | 1 Bedroom, 1 Bath

12 East 75th Street, #4F (Sothebys International Realty)

Turtle Bay Towers, #20H (Keller Williams NYC)

41 Spring Street, #4BR (Douglas Elliman Real Estate)

The Parc Vendome, #4I (Douglas Elliman Real Estate)

The Grand Beekman, #15C

$2,190,000 (-2.7%)

Beekman/Sutton Place | Condominium | 2 Bedrooms, 2 Baths | 1,300 ft2

The Grand Beekman, #15C (Corcoran Group)

The Boulevard, #PH8 (Brown Harris Stevens Residential Sales LLC)

Investor-only listings

317 East 73rd Street, #4RW

$439,000

Lenox Hill | Cooperative | 1 Bedroom, 1 Bath

317 East 73rd Street, #4RW (Corcoran Group)

333 East 79th Street, #14V (Douglas Elliman Real Estate)

Le Bourgogne, #8I (Compass)

The Gallery House, #7C (SAMUEL REALTY GROUP LLC)

W Residences, #47G (Corcoran Group)

Avery, #7U (Corcoran Group)

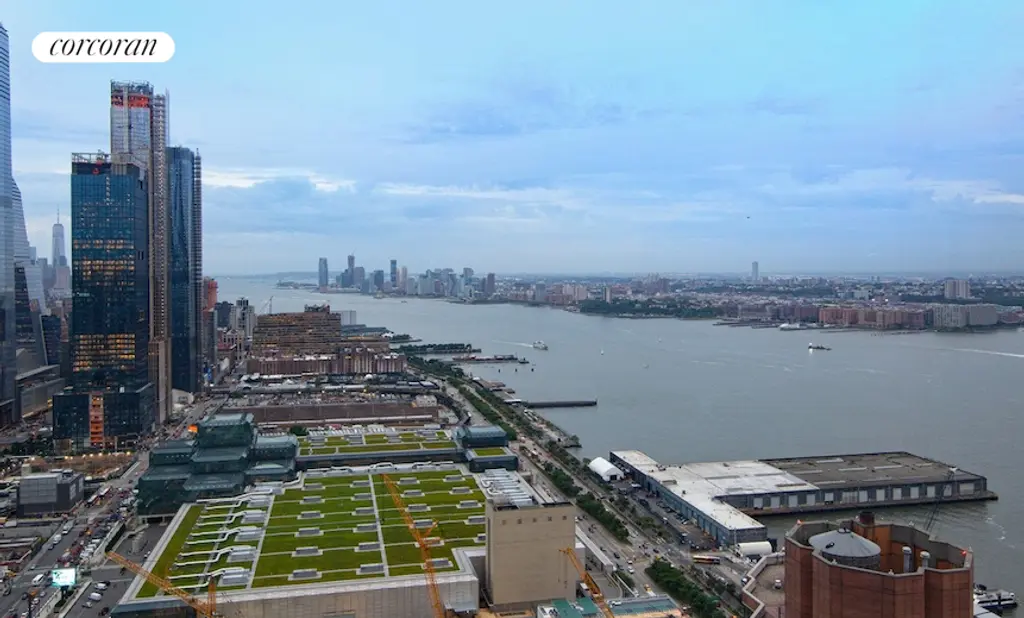

Zeckendorf Towers, #V7K

$1,195,000 (-7.7%)

Flatiron/Union Square | Condominium | Studio, 1 Bath | 492 ft2

Zeckendorf Towers, #V7K (Brown Harris Stevens Residential Sales LLC)

Atelier, #40F (Corcoran Group)

Three Ten, #10A (Douglas Elliman Real Estate)

Bridge Tower Place, #38AB (Douglas Elliman Real Estate)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.