240 Carroll Street, Unit 3 (Coampass)

240 Carroll Street, Unit 3 (Coampass)

Whether you're buying a luxury condo or an entry-level co-op, bidding wars have become common for approachably-priced units in sought-after locations. While elevated interest rates have priced out some buyers, in some markets they’ve only made bidding wars less intense—not eliminated them altogether. As more people have turned to renting instead of buying, a new challenge has emerged: bidding wars in the rental market. This article explores how to win a bidding war, whether you're buying or renting, and more importantly, how to avoid getting caught in one in the first place.

In this article:

Bidding Wars on the Buying Side of the Market

When you're looking to buy a property in a high-demand and low-inventory market, bidding wars are often a factor with which you must contend. Unique to the pandemic market has been the number and intensity of bidding wars.

Early in the pandemic, as many New Yorkers fled the city, bidding wars surged over suburban homes and rural properties. As time went on, they became common in popular Brooklyn neighborhoods, with buyers seeking larger apartments and townhouses. Since 2022, rising mortgage rates have made bidding wars less frequent. However, activity has picked up in recent months, and new supply—especially in Manhattan—remains limited. As buyers adjust to higher rates and the rental market stays red-hot, competition for well-priced units in prime locations is expected to intensify. So, how do you win a bidding war??

Early in the pandemic, as many New Yorkers fled the city, bidding wars surged over suburban homes and rural properties. As time went on, they became common in popular Brooklyn neighborhoods, with buyers seeking larger apartments and townhouses. Since 2022, rising mortgage rates have made bidding wars less frequent. However, activity has picked up in recent months, and new supply—especially in Manhattan—remains limited. As buyers adjust to higher rates and the rental market stays red-hot, competition for well-priced units in prime locations is expected to intensify. So, how do you win a bidding war??

Bid high but over your threshold or the home’s appraised value

Don't go bargain hunting if you're likely to face a bidding war. Under-bidding won't get you anywhere. That said, also avoid going to the opposite extreme and bidding well over the asking price. If you do and you require financing, you may not be approved, even if you previously prequalified. But even if you put in a high bid and can afford the additional cost, there is another risk: being stuck with a property that is worth significantly less than the purchase price. Especially as we enter a volatile economy, holding property that is worth less than the purchase price comes with obvious risks.Consider writing a homeowners’ “love letter”

As stated on the National Association of Realtors' (NAR) website: “To entice a seller to choose their offer, buyers sometimes write ‘love letters’ to describe the many reasons why the seller should ‘pick them.’” Some families go further, including pictures and even video testimonies of their families. While they may appear harmless, as the NAR further notes, “these letters can actually pose fair housing risks because they often contain personal information and reveal characteristics of the buyer, such as race, religion, or familial status, which could then be used, knowingly or through unconscious bias, as an unlawful basis for a seller’s decision to accept or reject an offer.” In fact, buyers’ love letters are so controversial that in recent years several states, including Oregon, Washington, and California, have imposed bans on the letters. However, in March 2022, a federal judge overturned the state bans, concluding that banning buyers’ love letters violates First Amendment rights. So, do they work? In the case of a multi-offer situation, the reality is that a personal appeal to the owner can be a criteria factor.Let the seller set the timeline for closing

Although some advice on how to win a bidding war on a home suggests waiving contingencies (e.g., your home inspection or financing contingency), waiving contingencies designed to protect you and your money is never advisable. In most cases, potential buyers do this to ensure a quick close. A better strategy is to maintain all the contingencies in your contract but commit to the fastest possible close. After all, most sellers' are eager to close as soon as possible. If the seller, however, needs more time, also agree to work with the timeline. Letting them move out when they are ready (e.g., when they have found a new home) is another great way to secure a home when facing tough competition from other buyers.Look for whisper listings

The best way to win a bidding war is to never enter one in the first place. In fact, this is one of the reasons that whisper listings or pocket listings have become increasingly popular over the past two years. In a nutshell, these listings are never publicly listed (e.g., on the MLS), and as a result, attract fewer buyers, reducing the likelihood of a multi-offer situation.

Bidding Wars on the Rental Side of the Market

As buying a home becomes more difficult due to surging interest rates, high demand, and low

inventory, it is no surprise that the demand for rental units is also surging, and this is creating bidding wars on the rental side of the market. In fact, according to Douglas Elliman, in May 2022, over 18% of rental listings led to bidding wars. For renters, finding and securing an apartment isn't the only challenge. As bidding wars heat on the rental side of the market, brokerage fees are also surging.

Just two years after New York State banned brokerage fees in cases where brokers are representing a landlord (this regulation was quickly overturned after the Real Estate Board of New York and the New York State Association of Realtors filed a lawsuit) brokers are reporting some of the highest fees ever on rentals. According to one account, some brokers are now charging renters as much as 18-20% of the first year’s rent to help secure a unit (in the past, the average has been closer to 8.5%, with high brokerage fees peaking around 15%).

Unsurprisingly, the current situation is leading many renters to adopt strategies not unlike that of desperate buyers (e.g., offering to pay more than the asking price, renting apartments that haven't yet gone on the market and renting apartments site unseen and writing renter "love letters"). There are also a few other things one can do to win a bidding war on the rental side of the market.

Just two years after New York State banned brokerage fees in cases where brokers are representing a landlord (this regulation was quickly overturned after the Real Estate Board of New York and the New York State Association of Realtors filed a lawsuit) brokers are reporting some of the highest fees ever on rentals. According to one account, some brokers are now charging renters as much as 18-20% of the first year’s rent to help secure a unit (in the past, the average has been closer to 8.5%, with high brokerage fees peaking around 15%).

Unsurprisingly, the current situation is leading many renters to adopt strategies not unlike that of desperate buyers (e.g., offering to pay more than the asking price, renting apartments that haven't yet gone on the market and renting apartments site unseen and writing renter "love letters"). There are also a few other things one can do to win a bidding war on the rental side of the market.

Get your paperwork in order and bring it to the open house

In today's rental market, no one has time to wait for a prospective tenant to get their paperwork together. If you're on the rental market, know your price range (remember that it will be tough to rent anything that exceeds a third of your monthly income) and come in with proof you are making what you claim to be making. Among other things, be prepared to share your recent tax records with W2s or 1099s, recent paystubs, and potentially even bank statements. Having all this paperwork on hand and ready to hand over at a showing is a great way to get to the front of the line.Create a renter resume

In addition to showing up with your required financial paperwork in order, create a renter resume, essentially a one- to two-page overview listing all your addresses in recent years with contact information for all your past landlords and other pertinent information (e.g., your current employer, length of employment, etc.). It's not a requirement, but most landlords and management companies—not to mention the brokers who will present your case to these owners—will appreciate the effort to be fully transparent.Show up as a model tenant

Although subject to ongoing debate, in most cases, landlords can reject tenants with pets or certain types of pets (e.g., dogs over 20 pounds), unless the pet is a service animal. Likewise, landlords have considerable leeway to select tenants for other reasons (e.g., to rent to a librarian with a full-time position over a self-employed drummer). The more you can do to show looking like a model tenant, the better off you'll be.Great listings that just might spark a bidding war

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

237 Hancock Street, #5 (Compass)

206 Lincoln Place, #6 (Corcoran Group)

324 West 88th Street, #PARLOR (The Agency Brokerage)

114 West 81st Street, #2F (Compass)

169 West 73rd Street, #9 (Compass)

712 Sackett Street, #3F (Brown Harris Stevens Residential Sales LLC)

65 Gates Avenue, #2 (Douglas Elliman Real Estate)

293 Riverside Drive, #3A4A

$1,100,000 (-8.3%)

Riverside Dr./West End Ave. | Cooperative | 2 Bedrooms, 2 Baths

293 Riverside Drive, #3A4A (Compass)

1235 Dean Street, #2 (Corcoran Group)

572 Saint Marks Avenue, #3 (Corcoran Group)

406 Degraw Street, #2 (Compass)

358 Douglass Street, #3 (Compass)

79 Perry Street, #2F (Archpoint Advisory)

21 West 9th Street, #1FR (Compass)

48 Gramercy Park North, #3B (Brown Harris Stevens Residential Sales LLC)

34 West 88th Street, #4 (Sothebys International Realty)

917 President Street, #3 (Corcoran Group)

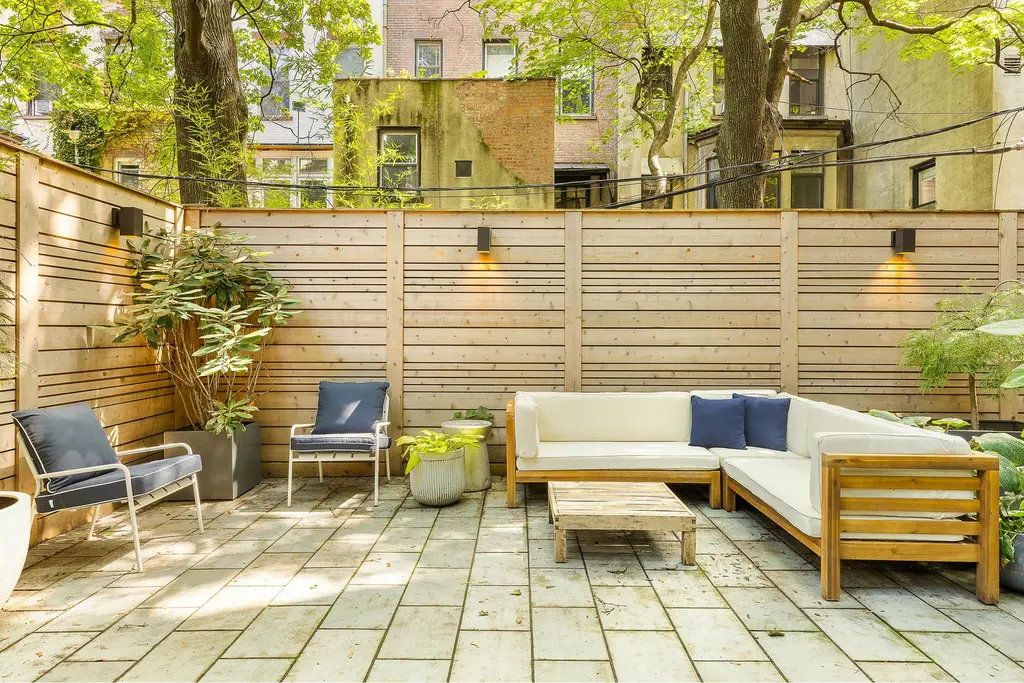

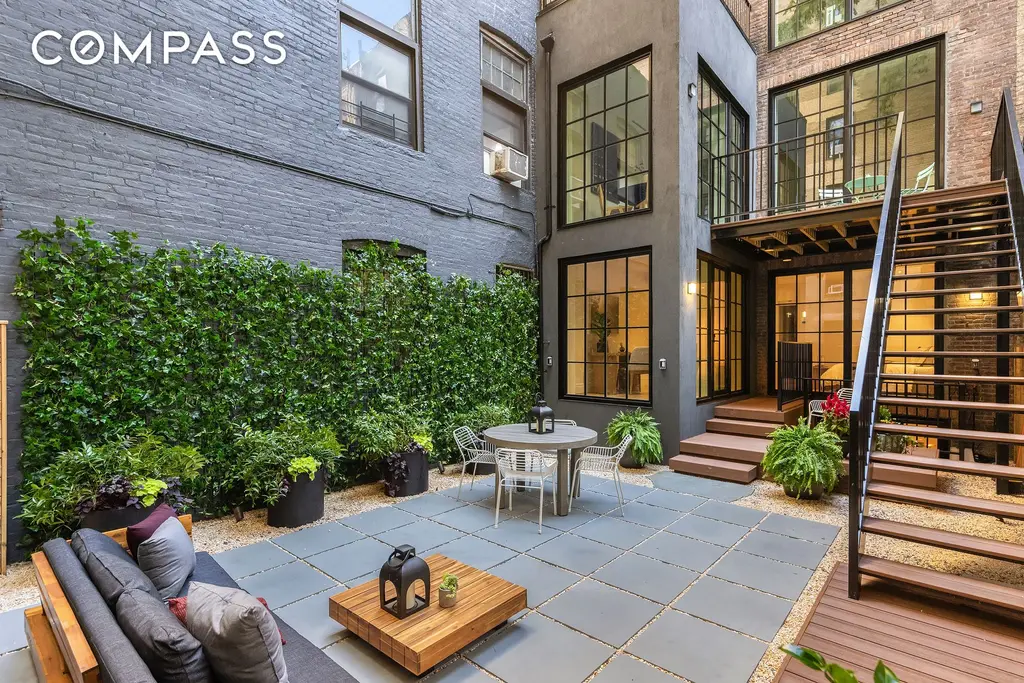

240 Carroll Street, #3 (Compass)

The Lincoln, #3B (Corcoran Group)

102 West 118th Street, #GARDEN (Compass)

84 Sixth Avenue, #1 (Compass)

57 West 130th Street, #DUPLEX (Douglas Elliman Real Estate)

76 1st Place, #4 (Douglas Elliman Real Estate)

217 Lafayette Avenue, #1 (Douglas Elliman Real Estate)

582 Pacific Street, #1 (Serhant LLC)

344 West 84th Street, #PARLOR

$5,950,000

Riverside Dr./West End Ave. | Condominium | 3 Bedrooms, 4 Baths | 3,364 ft2

344 West 84th Street, #PARLOR (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.