150 West 95th Street, #3C (Compass)

150 West 95th Street, #3C (Compass)

As of August 2024, mortgage rates have dropped to their lowest in over a year, yet adjustable-rate mortgages (ARMs) continue to be a popular choice as rates stay significantly higher than the lows seen before 2022. In times of elevated interest rates, ARMs often stand out as an appealing financing option for buyers. However, regardless of market conditions, it's crucial for buyers to weigh the pros and cons of these mortgage products carefully.

In this article:

Fixed-Rate Mortgages

A fixed-rate mortgage is exactly what one might expect—a mortgage with a rate that holds for the entire term of the mortgage. Said differently, if you lock in at 5.8% for 30 years, that's the rate you'll have until you either sell your home or refinance.

Pro:

When rates are low, a fixed-rate mortgage offers great peace of mind. For example, anyone who locked in to a 2.75 or 2.8 percent mortgage in 2021 will enjoy that rate until they sell or pay off their home, whatever happens to the economy and the prime interest rate. However, even if you lock in to a fixed-rate mortgage at 5 or 6 percent, these mortgages still offer something that no other mortgage offers—certainty. Whatever happens, you’ll always know how much you’ll be expected to pay down on your mortgage month-to-month.

Con:

When interest rates increase, fixed-rate mortgage rates don’t typically offer the best rates. Indeed, fixed-rate mortgages are often a whole percentage point higher than APR mortgages or ARMs.

Adjustable-Rate Mortgages (ARMs)

Also known as variable-rate mortgages, in the case of an ARM, one’s mortgage rate fluctuates over time. In most cases, ARMs start with a fixed rate and then move to an adjustable or floating rate after a specific period of time (e.g., two or five years).

Pro:

The main reason to opt for an ARM over a fixed-rate mortgage is the favorable rates these mortgages offer. Currently, most ARMs are approximately 1 percentage point lower than most fixed-rate rates, which can offer considerable savings over time.

Con:

An obvious problem with any ARM is that you can't fully predict how much you'll end up paying on your mortgage down the line. For this reason, if you're someone with low risk tolerance, an ARM may not be the right mortgage product for you, even if it offers a better rate to start.

You Likely Don't Need a Long-Term Fixed-Rate Mortgage

While it may have been comforting to lock in to a 30-year mortgage at 2.75 percent back in 2021, the reality is that the vast majority of people who took advantage of 2021’s historically low rates will sell long before their fixed-rate mortgages expire. According to the National Association of Realtors, as of 2021, the average U.S. home was only owned for 13.2 years. In New York City and the surrounding area, the average tenure of home ownership was somewhat higher—15 years on average. But even factoring in the region's longer homeownership rates, the average New Yorker still sells before the life of their mortgage expires. Given this, the risks associated with opting for an ARM versus a fixed-rate mortgage are actually not as great as one might assume. However, even if you don't move, if and when interest rates come down, you can modify or refinance your loan as needed.

A loan modification refers to any change to the original terms of your mortgage. If interest rates suddenly drop, for example, some lenders will work with borrowers to modify their loans to help them take advantage of the new lower rates. In some cases, you may even be able to modify an ARM to lock in to a fixed-rate mortgage at a lower rate. For lenders, it is often more advantageous to modify an existing loan than risk losing a credit-worthy customer to another lender. But even if your lender won't modify your loan, you still have options.

Another way to acquire a more preferable rate is to refinance. While this can be a great way to lock in to a lower rate and even switch from an ARM to a fixed-rate mortgage, when refinancing, you may be hit with a penalty. While not always applicable, some lenders do impose penalties on certain mortgages when paid off before the term's expiration date. Since refinancing will result in paying off the existing mortgage early, penalties may apply. If you stand to pay considerably less in interest over time, however, the overall savings will likely still outweigh any penalty paid for refinancing.

Beautiful new listings in Manhattan

347 West 22nd Street, #3 (Corcoran Group)

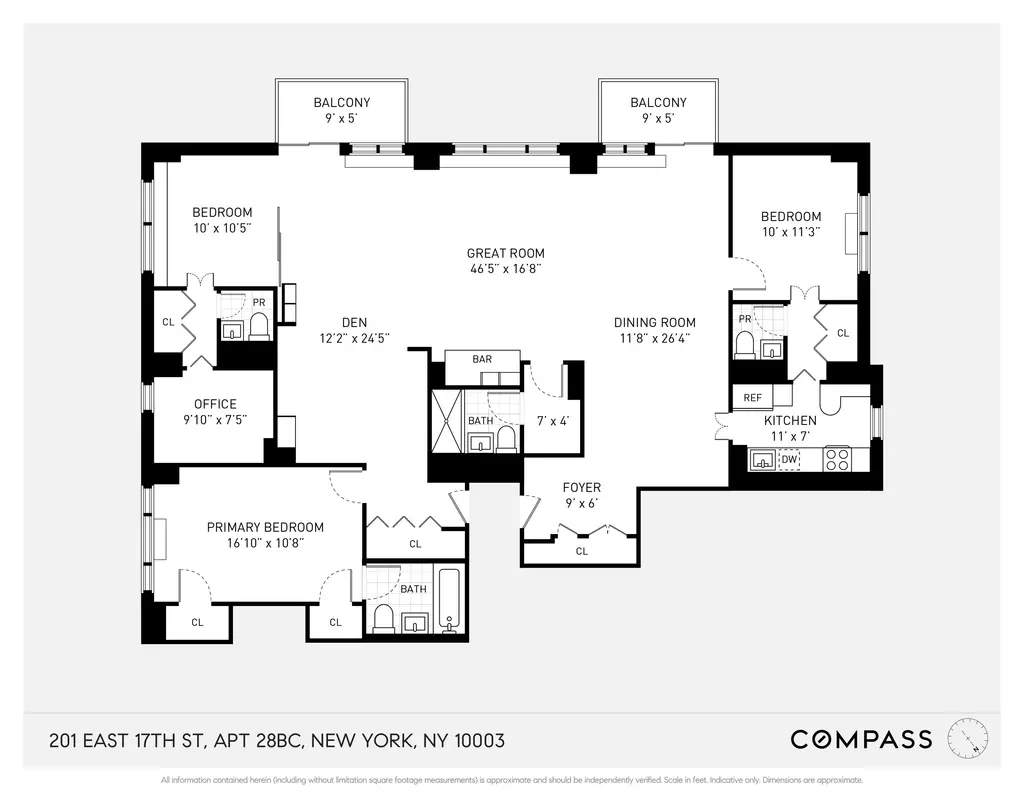

Park Towers, #28BC (Compass)

456 West 19th Street, #23B (Compass)

21 East 22nd Street, #6H (Corcoran Group)

50 East 79th Street, #7B

$1,625,000

Park/Fifth Ave. to 79th St. | Cooperative | 2 Bedrooms, 1.5 Baths

50 East 79th Street, #7B (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

205 East 78th Street, #10EF (Compass)

150 West 95th Street, #3C (Compass)

The Sequoia, #12B (Brown Harris Stevens Residential Sales LLC)

232 East 6th Street, #2B (Coldwell Banker Warburg)

Loft 25, #7B (Corcoran Group)

Connaught Tower, #33FG (Douglas Elliman Real Estate)

The Royal York I, #W4D (Keller Williams NYC)

The Landmark, #1706 (Corcoran Group)

250 West 27th Street, #4E (Serhant LLC)

West Village Houses, #GB (Serhant LLC)

Haddon Hall, #1004C (Corcoran Group)

200 West 108th Street, #12F (Brown Harris Stevens Residential Sales LLC)

242 West 104th Street, #3WF (Corcoran Group)

The Alameda, #12F (Douglas Elliman Real Estate)

102 West 80th Street, #87 (Compass)

The San Giorgio, #5 (Brown Harris Stevens Residential Sales LLC)

Turtle Bay Towers, #15T (Compass)

102 West 85th Street, #5B (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.