The Caledonia #2407 (Keller Williams NYC)

The Caledonia #2407 (Keller Williams NYC)

Members screen and select new residents via their elected representatives (the co-op board). You may be familiar with many of the better-known differences between condos and co-ops: The building’s approval process, financial requirements, and rules are usually more stringent in a co-op, but co-ops generally cost less to purchase.

Co-ops comprise a much larger percentage of the city’s owned housing units–about 70 percent, though this number is steadily falling as many new condos come to market and virtually no new co-ops are being constructed. Co-ops have a history of being the upper-echelon choice in highly sought-after Manhattan neighborhoods like the Upper East Side and Upper West Side. If you’re looking for elegant old-world architectural details, know that many of the city’s classic pre-war buildings are co-ops–and the rare condo conversions of pre-war apartment buildings tend to be very expensive.

In this article:

If you’re a foreign buyer, hope to buy with a very low down payment, plan to use the unit as a pied-a-terre or rental investment, or hope to sell at a profit within a short time, you may find yourself frustrated in the co-op market.

Murray Hill

Murray Hill

Pros of Buying a Co-op

• Co-ops are usually cheaper to purchase than condos.

• There are more of them: Co-ops make up a much larger percentage of the city’s owned housing units (around 75 percent).

• There are many more pre-war co-ops available than condos.

• Co-ops have slightly lower closing costs; title insurance isn’t needed and there is no mortgage recording tax.

• A thorough vetting process and stricter financial requirements mean more financial stability, especially in market downturns.

• The vetting process and restrictions mean more owner-occupied units and less turnover, which can prevent problems like a revolving cast of renters, illegal Airbnb use, and other potential disruptions.

• A portion of monthly maintenance fees is tax-deductible.

• Co-op shareholders are also considered tenants of the co-op, which gives them legal protections under New York City landlord-tenant law.

Cons of Buying a Co-op

• The approval process and building rules are usually stricter in a co-op, and potential buyers can be rejected without having to provide a reason; condo boards can’t legally reject potential buyers.

• Co-ops generally require buyers to make a down payment of at least 20 percent of the purchase price, sometimes as much as 50 percent or more; some exclusive buildings don’t allow financing at all. Co-ops also have liquid asset requirements and may ask buyers to meet a debt-to-income ratio and have an excellent credit score.

• Stricter financial requirements mean you’ll be asked to share more personal financial information.

• Limits on subletting, purchasing for others, and pieds-a-terre mean co-ops are not a good choice for investment buyers who don’t plan to live in the building or who are looking for short-term ownership.

• Monthly maintenance fees are generally higher for co-ops than for condos, as a share of the property tax and possibly payment toward an underlying mortgage is included.

• The purchasing process generally takes longer.

• Most new developments (1980s and later) are condos; if new is what you're looking for, you’ll likely have to go condo.

• Co-ops are more difficult for foreign buyers to purchase as they often don’t have the necessary records from a U.S. bank, and co-ops do not allow anonymous purchasing by LLCs.

Featured newly-listed co-op apartments

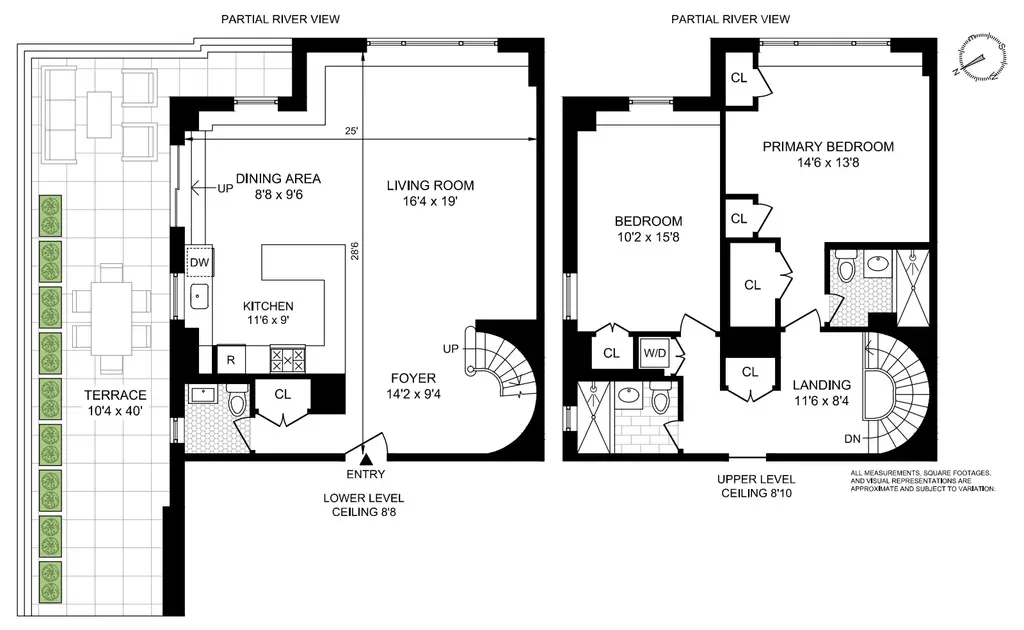

194 Riverside Drive, #4B

$1,650,000

Riverside Dr./West End Ave. | Cooperative | 2 Bedrooms, 2 Baths | 1,400 ft2

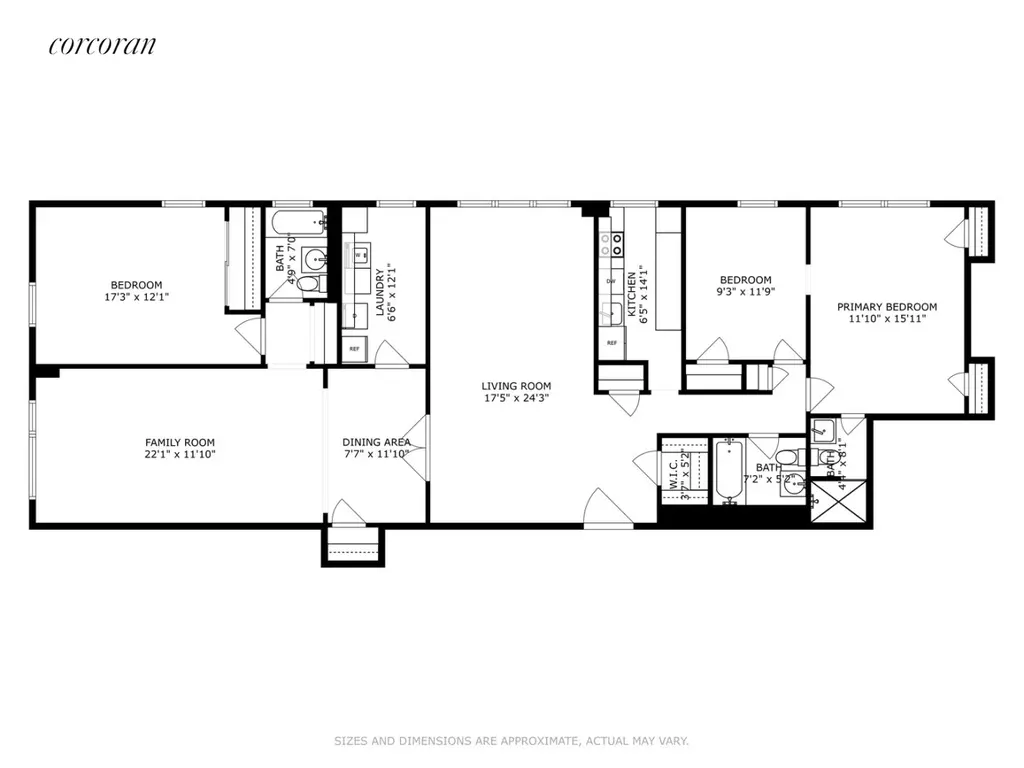

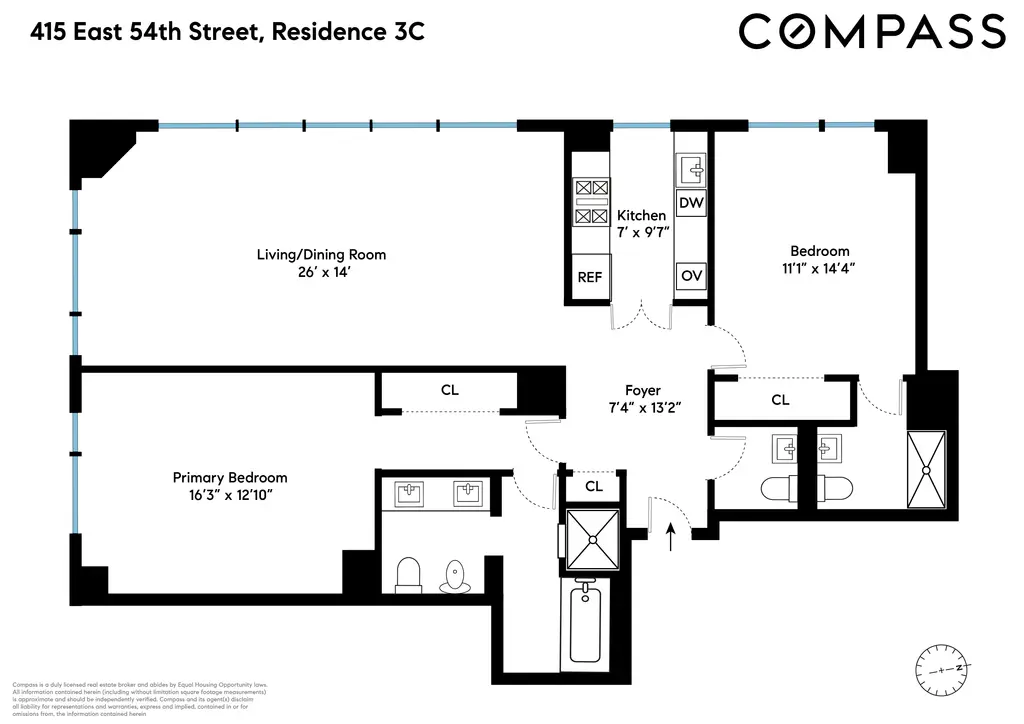

St. James Tower, #3C

$1,325,000

Beekman/Sutton Place | Condominium | 2 Bedrooms, 2.5 Baths | 1,253 ft2

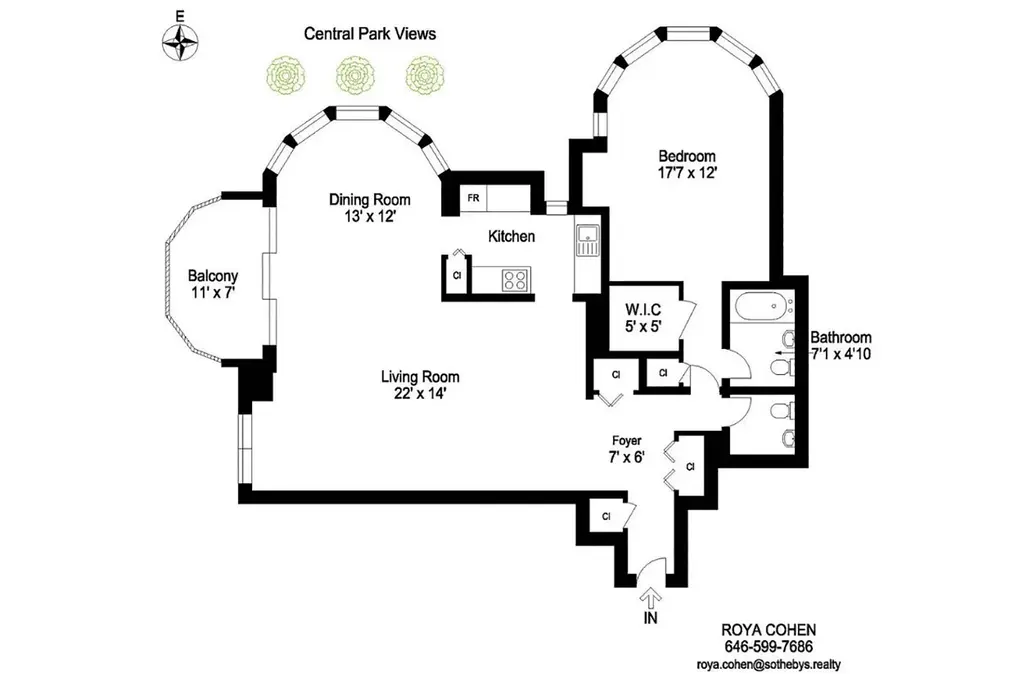

66 Washington Avenue, #5R

$2,100,000 (-7.7%)

Clinton Hill | Condominium | 2 Bedrooms, 1 Bath | 1,132 ft2

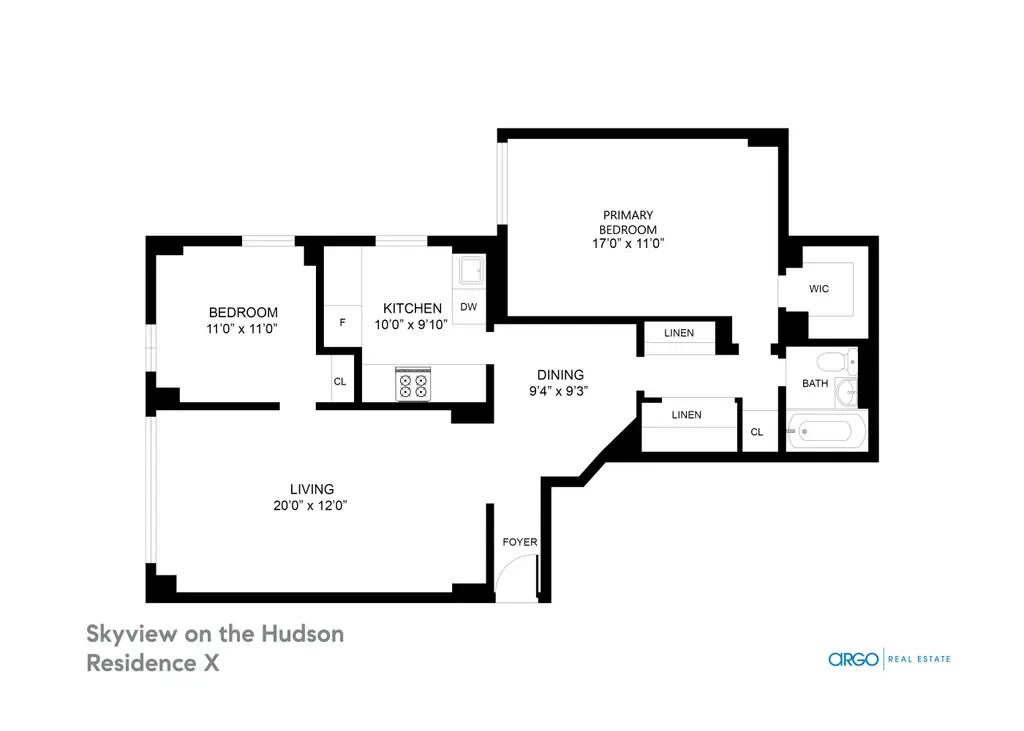

The Parkville, #5

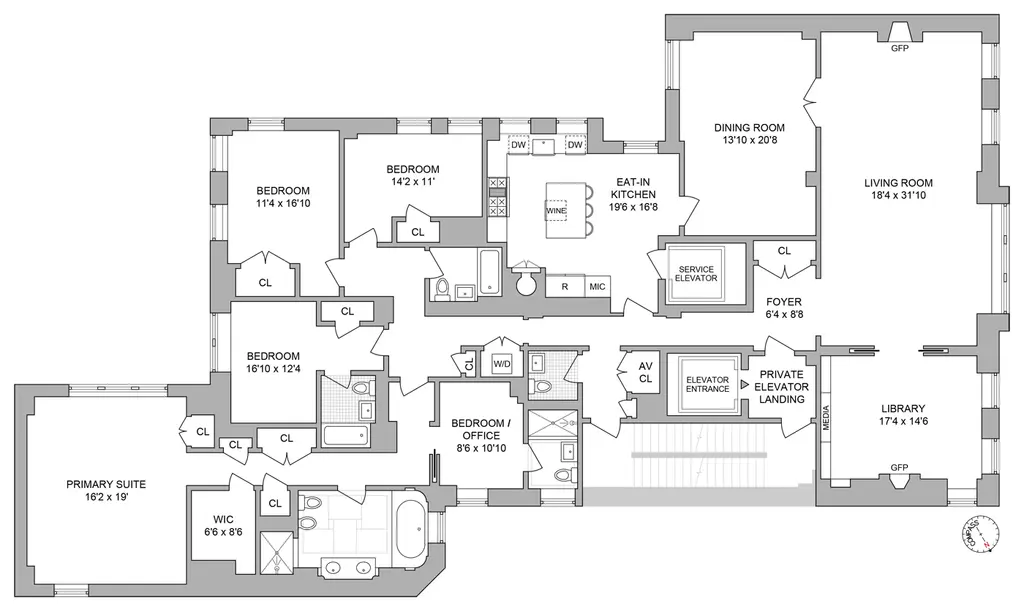

$12,495,000

Park/Fifth Ave. to 79th St. | Condominium | 5 Bedrooms, 4.5 Baths | 4,184 ft2

The Apthorp, #2ABC

$26,000,000

Riverside Dr./West End Ave. | Condominium | 6+ Bedrooms, 6+ Baths | 8,557 ft2

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.