323 West 80th Street, #TH (Compass)

323 West 80th Street, #TH (Compass)

Once an offer is accepted, buyers typically have a relatively short window of time between the offer’s acceptance and the closing date to get all their paperwork in order. During this time, which is generally 40 to 50 days, the onus is on the buyer to secure financing while also arranging to have the unit inspected, appraised, and insured. To ensure you don’t end up failing to secure financing before an established closing date, most agents recommend that you get pre-approved for a mortgage before you start bidding.

In this article:

Pre-Approved Versus Pre-Qualified

First, it is important to understand the difference between being pre-approved and pre-qualified. A pre-qualification simply is an estimate to determine how much you can spend on a home purchase, but it is not a guarantee that the lender will approve financing. By contrast, a pre-approval entails a credit check. In essence, if you’ve been pre-approved, the lender has already committed to lending you a certain amount of money for your home purchase. In most cases, pre-approvals are capped (e.g., at 90 days) and in all instances, a pre-approval is not a final loan approval. You will only be able to finalize your loan once you’ve put in a bid and had an appraisal carried out on the property you intend to purchase.

Shopping Around for Lenders

While you may want to talk to a loan officer at your local bank, in most cases, when you go on the market for a mortgage, you’ll want to shop around since your local bank may not have the best loan rates. There are two ways you can do this. First, you can simply do the research yourself. After all, information on lenders’ rates is now readily available online. Still, you might not be able to easily determine which lenders will offer you the best interest rates based on your credit history. Even if you can do this research, it may come with a downside, since making multiple hard credit inquiries can negatively impact your credit rating. For this reason, many people elect to work with a mortgage broker instead.

Like other types of brokers, mortgage brokers essentially serve as a bridge or intermediary. In this case, they serve as a bridge between buyers and lenders. The advantages of working with a broker is twofold. First, they know the lending landscape inside and out and will be able to quickly help you identify which lenders will likely work with you and which ones will offer the best rates. Second, they can help you anticipate all the paperwork you’ll need to get pre-approved. Also, bear in mind that while brokers are compensated, in most cases, the broker’s fee is paid by the lender, not client, so working with a broker will not necessarily increase your closing cost.

Like other types of brokers, mortgage brokers essentially serve as a bridge or intermediary. In this case, they serve as a bridge between buyers and lenders. The advantages of working with a broker is twofold. First, they know the lending landscape inside and out and will be able to quickly help you identify which lenders will likely work with you and which ones will offer the best rates. Second, they can help you anticipate all the paperwork you’ll need to get pre-approved. Also, bear in mind that while brokers are compensated, in most cases, the broker’s fee is paid by the lender, not client, so working with a broker will not necessarily increase your closing cost.

The Documentation Required to Get Pre-Approved

To get pre-approved for a loan, you’ll need to assemble a lot of paperwork. Be prepared to assemble the following items:

• Proof of income: To get a loan, you’ll need proof that you are employed. If you’re an employee, this will mean printing out W-2 statements for the past two years (to be on the safe side, you might want to go further back). Also print out pay stubs for the past twelve months and proof of any additional sources of incomes, including alimony. If you’re a freelancer, expect lenders to ask for a lot more documentation. As a rule of thumb, be prepared to bring your 1099s for the past three to five years and bank statements that show how much money you have flowing into your account every month. Whether you’re a salaried employee or freelancers, you’ll also need to bring tax returns for the past two years, but once again, if you’re a freelancer, be prepared to go further back (e.g., up to five years).

• Employment verification: In some cases, lenders will go one step further to verify your income. They may ask for employment verification letter (this will need to be obtained from your human resources office) and they may even ask for information in order to contact your current employer or employers directly.

• Proof of assets: In addition to proving that you have money coming in on a monthly basis, you’ll need to be transparent about your assets. To begin, be prepared to print out your bank statements and investment account statements to offer evidence that you do have a down payment. If your down payment is a gift from a family member or friend, you may also be asked to provide a letter proving this is the case. While this may sound intrusive, lenders will want proof that you haven’t taken out a loan that is not yet showing up in your credit history to acquire a down payment. If you don’t have a large down payment on hand and need a bit more help, you may be eligible for a HomeFirst Down Payment Assistance. This program offers loans up to $40,000 to New Yorkers who make 80% or less of the area median income.

• Proof of income: To get a loan, you’ll need proof that you are employed. If you’re an employee, this will mean printing out W-2 statements for the past two years (to be on the safe side, you might want to go further back). Also print out pay stubs for the past twelve months and proof of any additional sources of incomes, including alimony. If you’re a freelancer, expect lenders to ask for a lot more documentation. As a rule of thumb, be prepared to bring your 1099s for the past three to five years and bank statements that show how much money you have flowing into your account every month. Whether you’re a salaried employee or freelancers, you’ll also need to bring tax returns for the past two years, but once again, if you’re a freelancer, be prepared to go further back (e.g., up to five years).

• Employment verification: In some cases, lenders will go one step further to verify your income. They may ask for employment verification letter (this will need to be obtained from your human resources office) and they may even ask for information in order to contact your current employer or employers directly.

• Proof of assets: In addition to proving that you have money coming in on a monthly basis, you’ll need to be transparent about your assets. To begin, be prepared to print out your bank statements and investment account statements to offer evidence that you do have a down payment. If your down payment is a gift from a family member or friend, you may also be asked to provide a letter proving this is the case. While this may sound intrusive, lenders will want proof that you haven’t taken out a loan that is not yet showing up in your credit history to acquire a down payment. If you don’t have a large down payment on hand and need a bit more help, you may be eligible for a HomeFirst Down Payment Assistance. This program offers loans up to $40,000 to New Yorkers who make 80% or less of the area median income.

• Proof of service (for VA loans): There are a few loans options that do not require a high down payment, and this includes VA loans for U.S. veterans, service members, and not-remarried spouses. Of course, to ensure the VA loan program is not abused, it does require a bit of additional paperwork. If you’re seeking a VA loan and you’re no longer active, you’ll need a copy of your DD214, which is otherwise known as a Certificate of Release or Discharge from Active Duty. If you are still active, you’ll need a statement of service from your commanding officer. You’ll also need a completed request for a Certificate of Eligibility (form 26-1880) from the Department of Veterans Affairs and a completed Certificate of Eligibility. While this may sound a bit overwhelming, many lenders specialize in working with veterans and well positioned to walk veterans through these additional steps.

• Credit Score: While some loans are available to people with lower levels of credit, these loans are difficult to obtain (nearly impossible to obtain in New York City) and typically come with high interest rates. As a rule of thumb, in the current market, your credit score should be at least 620, but if you want options, you should at least have a FICO score above 700.

• Other documentation: To complete a credit check, your lender will need also need a copy of your driver’s license and social security number and may ask for a copy of your passport.

• Credit Score: While some loans are available to people with lower levels of credit, these loans are difficult to obtain (nearly impossible to obtain in New York City) and typically come with high interest rates. As a rule of thumb, in the current market, your credit score should be at least 620, but if you want options, you should at least have a FICO score above 700.

• Other documentation: To complete a credit check, your lender will need also need a copy of your driver’s license and social security number and may ask for a copy of your passport.

While assembling paperwork is by no means the most pleasant part of anyone’s home search, it is a necessary step, and the sooner you start, the better. Statistically, buyers who go on the market pre-approved are far less likely see their deals fall through. This is primarily a matter of timing. Once pre-approved, the underwriting process generally only takes one to two weeks. If you haven’t been pre-approved the financing process can take over a month and in some cases, this results in bidders failing to arrange financing before the agreed upon closing date.

Available NYC Listings Priced to Sell

155 East 49th Street, #4G (Compass)

24 Fifth Avenue, #712 (Barkoff Residential Inc)

The Murray Hill Crescent, #3C (Elegran LLC)

Castle Village, #17 (Compass)

Citylights, #4S (Modern Spaces)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

600 West 111th Street, #2B (Highline Residential LLC)

The Chesapeake House, #14S (Elegran LLC)

Connaught Tower, #12E (Compass)

306 West 100th Street, #65

$755,000 (-8.5%)

Riverside Dr./West End Ave. | Cooperative | 2 Bedrooms, 1 Bath

306 West 100th Street, #65 (Corcoran Group)

The Croft, #8B (Compass)

1947 Seventh Avenue, #9 (Weichert Properties)

84 Macdougal Street, #2

$1,300,000

Bedford-Stuyvesant | Condominium | 2 Bedrooms, 3 Baths | 2,236 ft2

84 Macdougal Street, #2 (Corcoran Group)

430 East 57th Street, #8A

$1,395,000

Beekman/Sutton Place | Cooperative | 2 Bedrooms, 2 Baths | 1,589 ft2

430 East 57th Street, #8A (Douglas Elliman Real Estate)

345 East 52nd Street, #11CD

$1,395,000 (-12.5%)

Midtown East | Cooperative | 2 Bedrooms, 2 Baths | 1,727 ft2

345 East 52nd Street, #11CD (Douglas Elliman Real Estate)

24 West 69th Street, #1A (Compass)

The Vantage, #22A (Douglas Elliman Real Estate)

70 Washington Street, #10H (Brown Harris Stevens Brooklyn LLC)

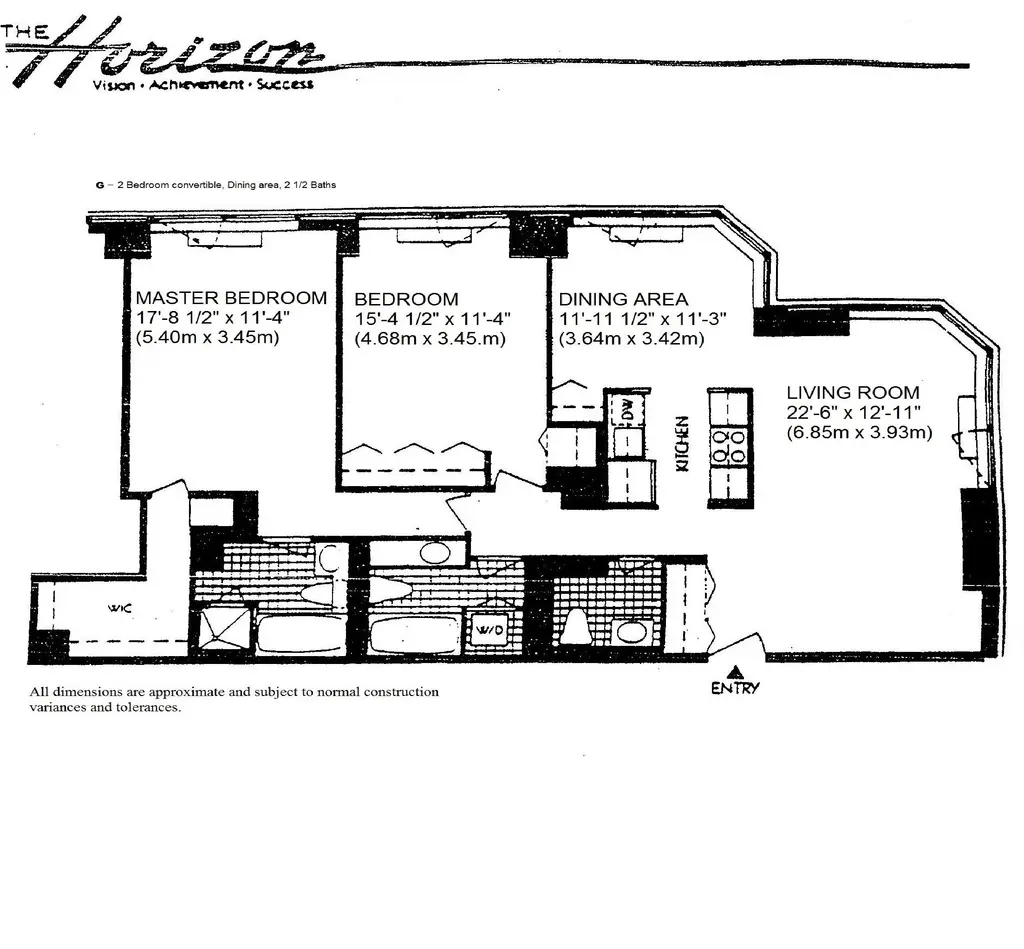

The Horizon, #41G (ADIN YORAM)

The Grand Beekman, #15C

$2,090,000 (-7.1%)

Beekman/Sutton Place | Condominium | 2 Bedrooms, 2 Baths | 1,300 ft2

The Grand Beekman, #15C (Corcoran Group)

One Manhattan Square, #10D

$2,180,000

Lower East Side | Condominium | 2 Bedrooms, 2 Baths | 1,123 ft2

One Manhattan Square, #10D (Corcoran Group)

25 Park Row, #15A

$3,650,000 (-3.3%)

Financial District | Condominium | 3 Bedrooms, 3.5 Baths | 2,061 ft2

25 Park Row, #15A (Corcoran Sunshine Marketing Group)

250 Bowery, #PHB (Compass)

224 East 50th Street, # (Vandenberg Inc)

The Julliard Building, #2D (Compass)

323 West 80th Street, #TH

$9,999,000 (-9.1%)

Riverside Dr./West End Ave. | Townhouse | 6+ Bedrooms, 6+ Baths | 11,670 ft2

323 West 80th Street, # (Compass)

Would you like to tour any of these properties?

Just complete the info below.

Or call us at (212) 755-5544

Would you like to tour any of these properties?

Contributing Writer

Cait Etherington

Cait Etherington has over twenty years of experience working as a journalist and communications consultant. Her articles and reviews have been published in newspapers and magazines across the United States and internationally. An experienced financial writer, Cait is committed to exposing the human side of stories about contemporary business, banking and workplace relations. She also enjoys writing about trends, lifestyles and real estate in New York City where she lives with her family in a cozy apartment on the twentieth floor of a Manhattan high rise.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.

6sqft delivers the latest on real estate, architecture, and design, straight from New York City.